SHELL SINGAPORE PTE LTD, A SUBSIDIARY OF SHELL PLC, HAS FINALIZED THE SALE OF ITS ENERGY AND CHEMICALS PARK IN SINGAPORE TO CAPGC PTE. LTD – A JOINT VENTURE BETWEEN CHANDRA ASRI CAPITAL PTE. LTD. AND GLENCORE ASIAN HOLDINGS PTE. LTD.

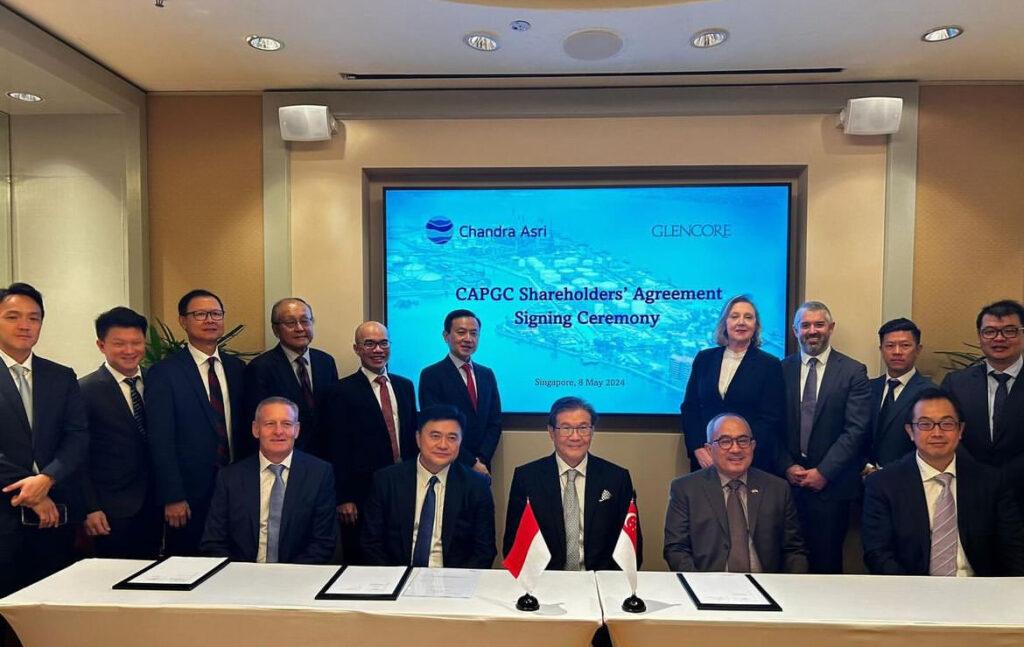

SHELL Singapore Pte Ltd, a subsidiary of Shell plc, concluded the sale of its Energy and Chemicals Park located in Singapore. The signing ceremony for the shareholder’s agreement took place between Chandra Asri Capital Pte. Ltd. and Glencore Asian Holdings Pte. Ltd. and marked the formalization of the agreement to transfer ownership of the Energy and Chemicals Park to CAPGC Pte. Ltd.

The shareholder’s agreement was signed in the presence of representatives from Shell Singapore Pte Ltd, Chandra Asri Capital Pte. Ltd., and Glencore Asian Holdings Pte. Ltd. on 8th May 2024. The agreement solidified the joint venture between Chandra Asri and Glencore, establishing CAPGC Pte. Ltd. as the entity responsible for acquiring Shell’s interest in the Energy and Chemicals Park in Singapore.

The sale of Shell’s Energy and Chemicals Park in Singapore to CAPGC Pte. Ltd. signifies a strategic move in the energy and chemicals industry. This transaction aligns with Shell’s ongoing portfolio optimization strategy, while also presenting new opportunities for CAPGC Pte. Ltd. to enhance its presence and operations in Singapore’s energy and chemicals sector.

Key stakeholders involved in the transaction include Chandra Asri Capital Pte. Ltd. which is Indonesia’s largest integrated petrochemical company; Glencore Asian Holdings Pte. Ltd., one of the world’s biggest oil traders and the leading diversified natural resource companies; and Shell Singapore Pte Ltd. The successful completion of the shareholder’s agreement and the subsequent sale of the Energy and Chemicals Park underscore the commitment of all parties to facilitating smooth transitions and fostering sustainable growth in the industry.

The sale of Shell’s Energy and Chemicals Park in Singapore to CAPGC Pte. Ltd. represents a notable development in the energy and chemicals sector. This transaction is expected to generate significant interest within the industry and among investors, as it reflects strategic realignment and consolidation efforts amidst evolving market dynamics.