Australia remains a top-tier global investment destination, demonstrating resilience amid global economic challenges. The country saw a significant increase in FDI in 2022, driven by opportunities in renewable energy and diverse sectors.

Australia’s Resilient Investment Climate

Australia continues to be a leading global investment destination, showing remarkable resilience despite global economic challenges. In 2022, the country ranked sixth globally for foreign direct investment (FDI), with inflows reaching A$89 billion, up from A$28 billion in 2021. This surge is notable given the 12% decline in global FDI and a 37% drop in FDI to developed economies during the same period.

Diverse Investment Opportunities

Australia offers vast potential for renewable energy investments and broader green economy development. The country is a global leader in Battery Energy Storage Systems (BESS), with over 40GW of announced projects. Additionally, Australia hosts nearly 40% of the world’s hydrogen projects, valued at up to A$300 billion, and holds significant deposits of critical minerals.

The Australian Government has committed to transitioning to net-zero emissions by 2050, targeting a 43% reduction in greenhouse gas emissions from 2005 levels by 2030. This commitment underpins investments and innovations in clean energy technologies, energy transition, and decarbonization.

Incentives for Investment and Innovation

Australian governments at federal and state levels offer a range of incentives to attract investments. The federal government has pledged almost A$25 billion to clean energy and renewable projects, complemented by a generous R&D tax incentive scheme, providing over 40% tax refunds on eligible R&D expenses.

Incentives extend to other priority sectors through initiatives such as the A$20 billion Medical Research Future Fund and the A$15 billion National Reconstruction Fund (NRF). The NRF supports private investment across seven priority sectors: resources, agriculture, forestry and fisheries, transport, medical science, renewables and low emission technologies, defense, and enabling capabilities in engineering, data science, and software development.

Singapore: A Major Investment Source

Singapore is a significant source of FDI in Australia, ranking eighth globally in 2022 with a total FDI stock of A$39 billion. Historically focused on real estate, hospitality, and agrifood, Singaporean investments are now diversifying into clean energy, circular economy, advanced tech, and healthcare.

Success Stories of Singaporean Companies in Australia

Several Singaporean companies have successfully expanded into Australia, showcasing the strong bilateral investment relationship. NCS, part of the Singtel Group, is capitalizing on digital transformation opportunities. Keppel has invested in the Central Queensland Hydrogen Project, collaborating with Australian and Japanese partners. TES-AMM is establishing a lithium battery recycling facility in Newcastle, supported by local grants. In healthcare, Homage has expanded its elder care services, and Cerecin is conducting clinical trials for neurological treatments in Australia.

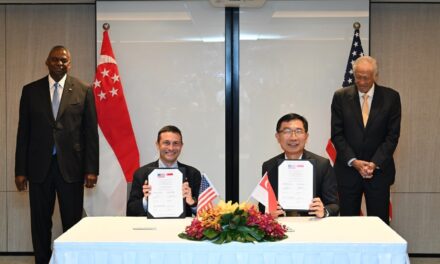

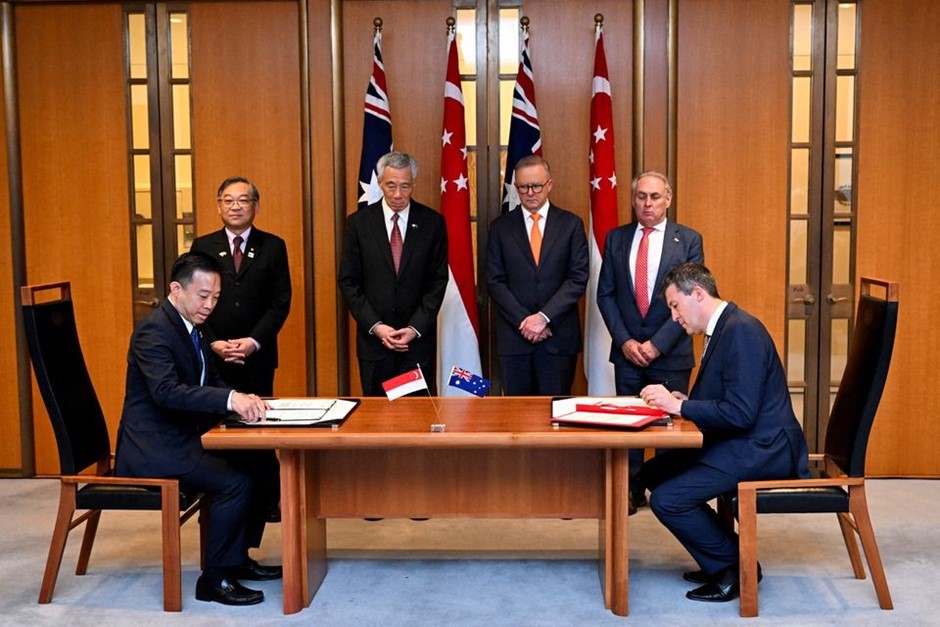

Strong Bilateral Support for Investments and Collaboration

Australia and Singapore share a deep, multifaceted partnership, strengthened by agreements such as the Singapore-Australia Free Trade Agreement (2003) and the Comprehensive Strategic Partnership (2015). Recent agreements, like the Digital Economy Agreement (2020) and the Green Economy Agreement (2022), enhance collaboration in trade, defense, science, innovation, and more.

The Australian Trade and Investment Commission (Austrade) and Enterprise Singapore are working together to unlock greater trade and investment opportunities. The Go Green Co-Innovation Program, with A$20 million in grants, supports sustainability and net-zero projects between companies from both nations. Additionally, national research agencies CSIRO and A*STAR are collaborating on R&D in key green sectors.

In October 2023, the Australian Government launched the Southeast Asia Economic Strategy to 2040, aiming to boost trade and investment with the region across ten priority sectors, recognizing Singapore’s role as a regional hub for green finance and carbon markets.

Connect with Austrade

Austrade, Australia’s federal investment and promotion agency, provides government assistance to attract and facilitate FDI. With offices worldwide, including in Singapore, Austrade offers local market expertise to support investors. Contact your nearest Austrade office to learn more about investment opportunities in Australia.