Finance leaders convene in Milan to enhance financial cooperation amid global uncertainties.

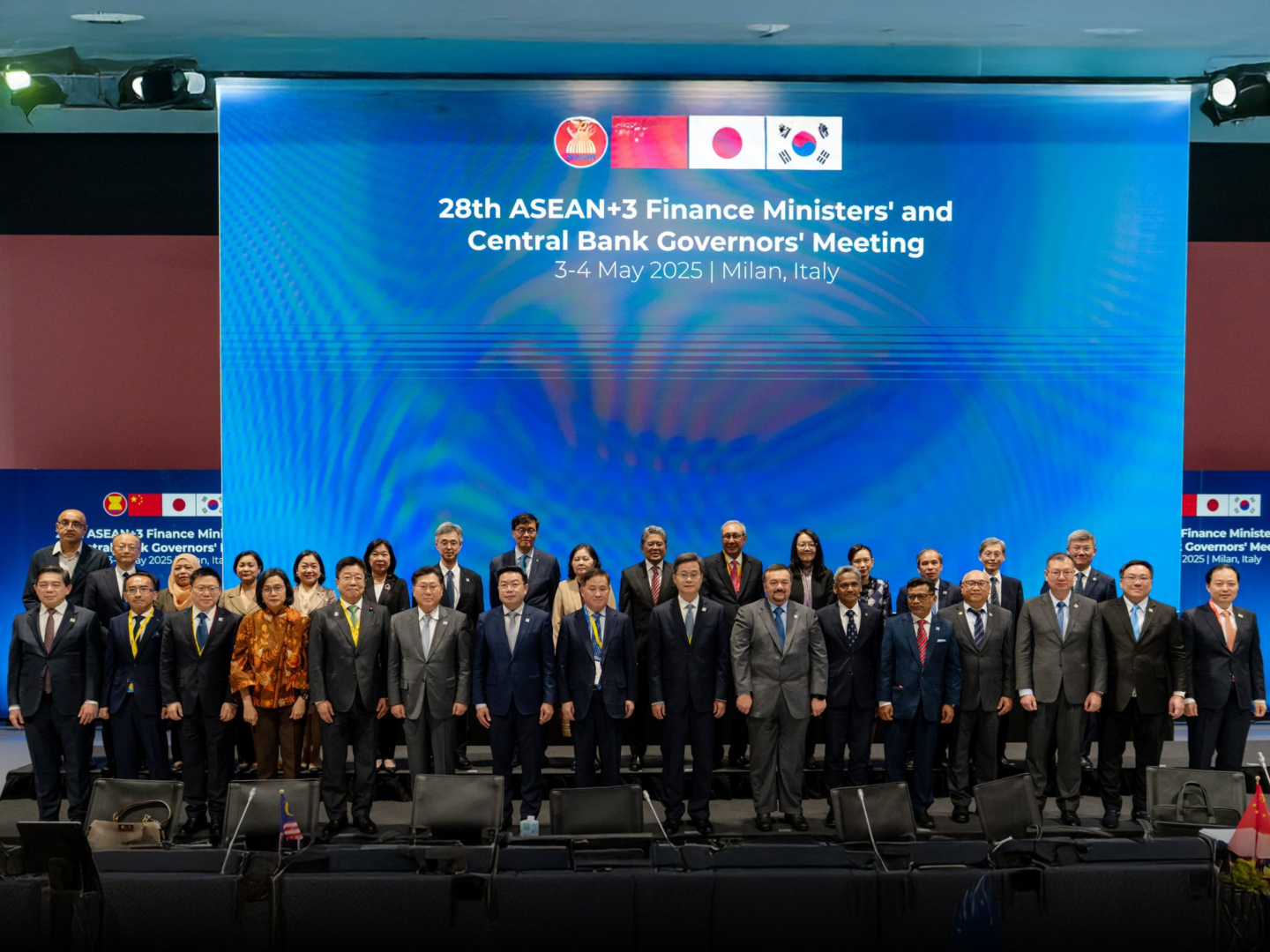

MILAN, Italy – Finance ministers and central bank governors from the ASEAN+3 nations, comprising the 10 ASEAN member states with China, Japan, and South Korea, concluded their 28th meeting on 4 May 2025 in Milan, Italy. The meeting, co-chaired by Malaysia and China, focused on strengthening regional financial cooperation and addressing macroeconomic challenges.

A significant outcome of the meeting was the approval of a new Rapid Financing Facility (RFF) under the Chiang Mai Initiative Multilateralization (CMIM). This facility aims to provide swift, unconditional financial support to member countries facing crises caused by pandemics or natural disasters, enhancing the region’s financial safety net. The CMIM currently holds a pool of $240 billion in foreign exchange reserves, with contributions from Japan, China, South Korea, and ASEAN members.

In addition to the RFF, the ministers endorsed the expansion of the ASEAN+3 Financial Think-tank Network and welcomed the new director of the ASEAN+3 Macroeconomic Research Office (AMRO). They also approved the concept document for the Disaster Risk Financing Initiative roadmap, aiming to bolster the region’s capacity to manage financial risks associated with natural disasters.

Chinese Finance Minister Lan Fo’an emphasized the importance of regional cooperation in the face of global economic challenges. He stated that the ASEAN+3 economies have demonstrated strong resilience and growth potential, and China is committed to working with partners to uphold openness and inclusiveness in regional financial cooperation.

The meeting also addressed the development of local bond markets and the need for technical assistance tools to tackle medium- to long-term structural challenges. Participants reaffirmed their commitment to a rules-based, free, and open multilateral trading system, recognizing the pivotal role of the ASEAN+3 Finance Process in supporting regional economies amid uncertainties.

Source: ASEAN