The International Fintech Forum (IFF) 2025 showcased Rwanda’s leadership in digital public infrastructure, cross-border payments, and financial inclusion

The International Fintech Forum (IFF) 2025 continued its discussions on digital public infrastructure and financial inclusion, with Rwanda reinforcing its role as a key driver of fintech innovation in Africa. Taking place in Kigali, the forum gathered global leaders, industry experts, and policymakers to explore solutions for advancing digital finance and cross-border payment systems.

On the second day of the event, President Paul Kagame reaffirmed Rwanda’s dedication to leveraging digital technologies for economic growth. “This forum is a testament to the unique partnership between Rwanda and Singapore to harness the power of the digital economy,” he stated, underscoring the importance of international collaboration in shaping the future of financial technology.

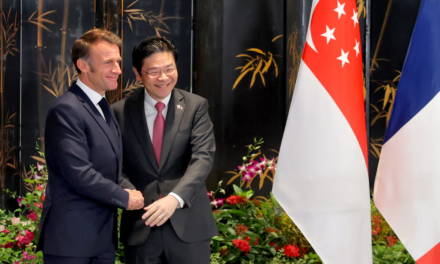

Discussions at the forum centred on the role of fintech in bridging infrastructure gaps, facilitating cross-border payments, and enhancing financial inclusion. Governor John Rwangombwa of the National Bank of Rwanda highlighted the need for a balanced regulatory framework to support innovative payment systems. Meanwhile, Minister of State for Trade and Industry of Singapore, Alvin Tan, stressed the importance of international collaboration in building an inclusive and efficient financial ecosystem across Africa.

Lacina Koné, Director General of the Smart Africa Secretariat, addressed the urgency of accelerating digital transformation to meet the Sustainable Development Goals (SDGs). Haim Taib, Founder and President of Mitrelli and JETA Africa Holding, underscored fintech’s potential in connecting farmers to markets and businesses to capital. Hon. Paula Ingabire, Rwanda’s Minister of ICT and Innovation, shared insights on Rwanda’s 96% financial inclusion rate, attributing it largely to mobile money adoption.

With strong commitments from African and global leaders, IFF 2025 reinforced the need for investment, regulatory harmonisation, and cross-border collaboration to drive sustainable fintech growth and financial accessibility across the continent.

Source: Inclusive FinTech Forum 2025