23 November 2022. The Ministry of Trade and Industry (MTI) announced today that Singapore’s GDP growth is projected to come in at “around 3.5 per cent” in 2022 and “0.5 to 2.5 per cent” in 2023.

Economic Performance in Third Quarter 2022

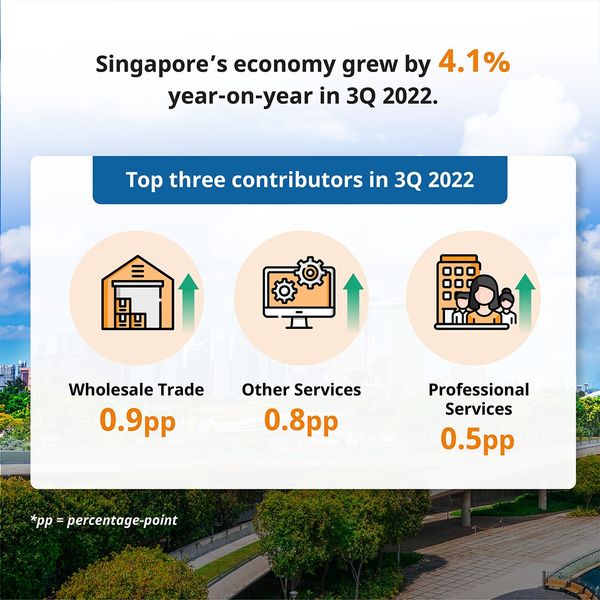

In the third quarter of 2022, the Singapore economy expanded by 4.1 per cent on a year-on-year basis, easing from the 4.5 per cent growth in the previous quarter. On a quarter-on-quarter seasonally-adjusted basis, the economy grew by 1.1 per cent, reversing the 0.1 per cent contraction in the second quarter.

By sectors, the manufacturing sector expanded at a slower pace of 0.8 per cent year-on-year, compared to the 5.6 per cent growth in the preceding quarter. Growth during the quarter was supported by output expansions in the transport engineering, general manufacturing and precision engineering clusters, which outweighed output declines in the electronics, chemicals and biomedical manufacturing clusters. On a quarter-on-quarter seasonally-adjusted basis, the sector shrank by 3.8 per cent, a reversal from the 0.4 per cent expansion in the second quarter.

The construction sector grew by 7.8 per cent year-on-year, accelerating from the 4.8 per cent growth in the previous quarter, as both public and private sector construction output rose. On a quarter-on-quarter seasonally-adjusted basis, the sector posted growth of 3.9 per cent, up from the 1.5 per cent in the second quarter.

The wholesale trade sector expanded by 5.4 per cent year-on-year, faster than the 1.6 per cent growth in the preceding quarter. Growth was supported by expansions in the machinery, equipment & supplies, and fuels & chemicals segments. On a quarter-on-quarter seasonally-adjusted basis, the sector grew by 4.2 per cent, a turnaround from the 3.1 per cent contraction in the second quarter.

The retail trade sector expanded by 8.9 per cent year-on-year, extending the 12.3 per cent growth in the previous quarter. Growth during the quarter was driven by an increase in non-motor vehicle sales volume even as motor vehicle sales volume fell due to a reduction in COE quotas. On a quarter-on-quarter seasonally-adjusted basis, the sector grew by 8.5 per cent, rebounding from the 6.5 per cent contraction in the preceding quarter.

Growth in the transportation & storage sector improved to 6.8 per cent year-onyear, from 5.0 per cent in the second quarter. Within the sector, the air transport segment recorded strong growth, mainly due to an increase in air passengers handled from a low base in the same quarter of last year. At the same time, the land transport and water transport segments also recorded expansions. On a quarter-on-quarter seasonally-adjusted basis, the sector grew by 2.4 per cent, picking up from the 1.4 per cent growth in the previous quarter.

The accommodation sector shrank by 1.9 per cent year-on-year, moderating from the 3.4 per cent contraction in the preceding quarter. The performance of the sector continued to be weighed down by the decline in government demand for quarantine and stay-home-notice dedicated facilities relative to a year ago, even though the recovery in international visitor arrivals provided some support. On a quarter-onquarter seasonally-adjusted basis, the sector contracted by 1.3 per cent, a sharp reversal from the 24.0 per cent growth in the previous quarter.

The food & beverage services sector saw robust growth of 30.5 per cent year-onyear from a low base last year, extending the 23.4 per cent expansion in the second quarter. Growth of the sector was bolstered by a strong pickup in sales volumes at food caterers, restaurants, and cafes, food courts & other eating places. On a quarter-on-quarter seasonally-adjusted basis, the sector shrank by 7.7 per cent, reversing from the 22.4 per cent growth in the preceding quarter.

The information & communications sector expanded by 6.2 per cent year-on-year, moderating from the 9.8 per cent growth in the previous quarter. Growth was led by the IT & information services segment, which was supported in turn by the strong performance of IT development, consultancy, data hosting and related activities. On a quarter-on-quarter seasonally-adjusted basis, the sector grew by 4.7 per cent, rebounding from the 1.5 per cent contraction in the second quarter.

Growth in the finance & insurance sector slowed to 0.4 per cent year-on-year, from 2.4 per cent in the preceding quarter. The sector’s weak performance was primarily due to a contraction in the banking segment on the back of a fall in net fees & commissions income. On a quarter-on-quarter seasonally-adjusted basis, the sector contracted by 2.0 per cent, a pullback from the 1.3 per cent growth in the previous quarter.

The real estate sector grew by 11.7 per cent year-on-year, extending the 11.1 per cent growth in the preceding quarter. Growth was largely supported by the private residential property segment, as well as the commercial office and industrial space segments. On a quarter-on-quarter seasonally-adjusted basis, the sector expanded by 1.5 per cent, a reversal of the 0.6 per cent contraction in the second quarter.

The professional services sector posted an expansion of 8.3 per cent year-on-year, similar to the 8.2 per cent growth registered in the previous quarter. Growth was mainly supported by the architectural & engineering, technical testing & analysis, and other professional, scientific & technical services segments. On a quarter-onquarter seasonally-adjusted basis, the sector grew by 1.0 per cent, easing from the 1.3 per cent growth in the preceding quarter.

Growth in the administrative & support services sector moderated to 7.9 per cent year-on-year, from 8.5 per cent in the second quarter. Within the sector, the other administrative & support services segment expanded, bolstered by a strong recovery in the activities of tour operators, travel agencies and MICE organisers. On a quarter-on-quarter seasonally-adjusted basis, the sector grew by 1.9 per cent, a turnaround from the 2.1 per cent contraction in the previous quarter.

The “other services industries” expanded by 8.0 per cent year-on-year, faster than the 5.5 per cent growth in the preceding quarter. Growth of the sector was broadbased, with the arts, entertainment & recreation, “others”1 , public administration & defence, and education, health & social services segments all clocking expansions. On a quarter-on-quarter seasonally-adjusted basis, the sector registered growth of 2.3 per cent, similar to the 2.2 per cent growth in the second quarter.

Economic Outlook for 2022

Since the Economic Survey of Singapore in August, Singapore’s external demand outlook has softened further due to the weaker outlook for the Eurozone economy amidst an energy crunch, as well as for China as it continues to grapple with recurring COVID-19 outbreaks and a property market downturn.

For the rest of the year, the weaker external economic outlook will weigh on the growth of outward-oriented sectors in Singapore, including the electronics and chemicals clusters. On the other hand, the strong recovery in air travel and international visitor arrivals is expected to continue to benefit aviation- and tourism-related sectors such as air transport and arts, entertainment & recreation, as well as consumer-facing sectors like food & beverage services. The lifting of travel restrictions in Singapore and the region has also boosted the recovery of the professional services sector.

Taking into account the performance of the Singapore economy in the first three quarters of the year (i.e., 4.2 per cent year-on-year), as well as the latest external and domestic developments, the 2022 GDP growth forecast for Singapore is narrowed to “around 3.5 per cent”, from “3.0 to 4.0 per cent”.

Economic Outlook for 2023

Looking ahead to 2023, GDP growth rates in most major economies are expected to moderate further from 2022 levels, with sharp slowdowns projected in the US and Eurozone. Meanwhile, global supply disruptions are likely to continue into 2023 as the war in Ukraine drags on, even though the extent and frequency of disruptions is expected to ease.

In the US, GDP growth is projected to slow significantly, as tighter financial conditions, a reduction in household savings, and negative household wealth effects arising from asset market corrections are expected to weigh on private consumption. Similarly, GDP growth in the Eurozone is forecast to slow sharply. In particular, higher cost pressures arising from significant energy disruptions due to the Russia-Ukraine war, alongside tighter financial conditions, are likely to dampen consumption and industrial production.

In Asia, China’s growth is projected to pick up from a low base but remain sluggish as its zero-COVID policy is likely to continue to constrain household consumption. Furthermore, while the financing measures introduced recently will help to alleviate the liquidity crunch faced by developers, the property sector is likely to remain weak in the near term. Meanwhile, GDP growth in the Southeast Asian economies of Malaysia and Indonesia is expected to moderate amidst weaker demand for their merchandise exports, although the ongoing recovery in domestic and tourism demand will provide some support.

At the same time, significant uncertainties and downside risks in the global economy remain. First, with many advanced economies raising interest rates simultaneously to combat high inflation, the impact of tightening financial conditions on global growth could be larger than expected. Second, financial stability risks could intensify if there are disorderly market adjustments to monetary policy tightening in the advanced economies. A sharp re-pricing of assets could trigger capital outflows from the region and increase debt servicing burdens, thereby dampening regional economies’ growth outlook. Third, further escalations in the war in Ukraine and geopolitical tensions among major global powers could worsen supply disruptions, dampen consumer and business confidence, as well as weigh on global trade.

Against this backdrop, the growth of outward-oriented sectors in Singapore is expected to weaken in tandem with the deterioration in external demand conditions. For instance, the semiconductors segment of the electronics cluster is expected to be negatively affected by the fall in global demand for semiconductors, while the machinery & systems segment of the precision engineering cluster is projected to be weighed down by a cutback in capital spending by semiconductor manufacturers amidst weak demand. At the same time, growth in the wholesale trade, water transport and finance & insurance sectors is expected to be dampened by the

slowdown in major external economies.

On the other hand, the growth prospects of several sectors remain positive. In particular, the continued recovery in air travel and international visitor arrivals will support the expansion of aviation- and tourism-related sectors like air transport, accommodation and arts, entertainment & recreation, as well as other related activities. The latter include the rental & leasing of air transport equipment within the administrative & support services sector, and aircraft engine maintenance and repair work for the aerospace segment within the transport engineering cluster.

Taking these factors into account, and barring the materialisation of downside risks, the Singapore economy is expected to grow by “0.5 to 2.5 per cent” in 2023.

MINISTRY OF TRADE AND INDUSTRY Singapore, 23 November 2022