The Monetary Authority of Singapore (MAS) introduces groundbreaking initiatives to pave the way for secure and innovative utilization of digital currency in Singapore.

In a strategic move towards embracing the digital future of finance, the Monetary Authority of Singapore (MAS) has announced three pivotal initiatives aimed at ensuring the safe and innovative use of digital money within the nation.

Firstly, MAS has unveiled a comprehensive blueprint delineating the essential infrastructure for a digital Singapore dollar. This blueprint encompasses key elements such as a settlement ledger to record digital money transfers, a tokenization bridge connecting existing settlement systems with tokenized digital money, a programmability protocol using Purpose Bound Money (PBM), and a Name Service for user-friendly verification.

To test the viability and broad applicability of these technologies, MAS will expand the digital money trials under Project Orchid. The trials will involve industry players, including OCBC and UOB exploring tokenized bank liabilities, Ant International, Fazz, and Grab piloting wallet interoperability using PBM, and Amazon and HSBC exploring tokenization for supplier financing. J.P. Morgan will also explore institutional payment controls for the transfer of deposit tokens within an agreed trust ecosystem.

In addition to retail and corporate trials, MAS plans to initiate the development of a central bank digital currency (CBDC) for wholesale interbank settlement in the coming year. This move follows previous simulations, with the first live issuance pilot involving the settlement of retail payments between commercial banks. Future pilots may extend to cross-border securities trade using wholesale CBDCs.

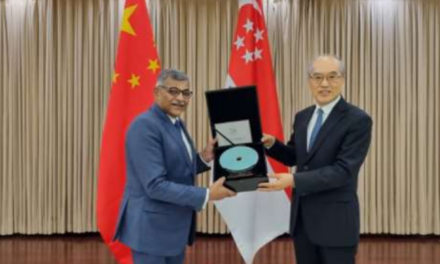

Mr. Ravi Menon, Managing Director of MAS, emphasized the significance of this milestone, stating, “The ‘live’ issuance of central bank digital money for use as a common settlement asset in payments is a significant milestone in MAS’ digital money journey that began in 2016. The issuance of wholesale CBDC reinforces the role that central bank money plays in facilitating safe and efficient payments.”

Source – MAS