From renewable energy to digital infrastructure, the Philippines outlines a compelling portfolio of opportunities for Singaporean firms amid a resilient economic trajectory.

Singapore, 13 June 2025 – As the Philippines marked its 127th year of independence on 12 June 2025, it is a fitting moment to reflect on its trade and investment journey from colonial dependency to regional integration. From its birth as a republic in 1898 to its present status as a dynamic player in the ASEAN region, the Philippines has steadily evolved its trade and investment policies to adapt to a shifting global landscape. From the American era’s export-driven economy to post-independence industrialization efforts, the country has navigated shifting global dynamics through resilience and reform. Key transitions include liberalization in the 1990s, the rise of services and BPO industries, and recent efforts to modernize infrastructure and deepen trade ties through ASEAN and global agreements. Today, the Philippines stands as a strategic and emerging hub in Asia, poised for inclusive, innovation-led growth anchored in sound economic diplomacy and a commitment to global partnership.

As part of the IN Diplomacy Trade Talk Series, the Embassy of the Philippines in Singapore shared a comprehensive update on the nation’s investment landscape and trade outlook, following a series of high-level engagements in Davos, Singapore, and Manila. With key reforms underway and a strategic focus on sustainability, innovation, and regional integration, the Philippines is positioning itself as a leading ASEAN growth hub and prime partner for Singaporean enterprises.

Q. Which sectors in the Philippines offer the greatest potential for trade and investment opportunities?

At the 2025 World Economic Forum Annual Meeting in Davos, the Philippines highlighted its economic resilience, sustainable development agenda, and inclusive growth strategy. Ambassador to the WTO Manuel Teehankee underscored the nation’s strong fundamentals and active global engagement. Alongside House Speaker Ferdinand Martin Romualdez, who stressed Asia’s rising global influence and the Philippines’ leadership ahead of its ASEAN 2026 chairmanship, the delegation engaged with international CEOs on growth sectors including digital finance, infrastructure, renewable energy, technology, and MSME development.

At the Pulse of Asia Conference 2025 in Singapore, Special Assistant to the President for Investment and Economic Affairs Frederick D. Go spotlighted the Philippines’ robust investment potential under the Marcos Jr. administration. He outlined priority sectors such as renewable energy, semiconductors, digital infrastructure, critical minerals, and healthcare manufacturing—areas aligned with global trends and backed by strong policy reforms. With initiatives including a 35% renewable energy target by 2030, a growing data centre market, and over USD 26 billion in infrastructure investment for 2025, the Philippines is positioning itself as a strategic investment destination in Asia.

Q: What are the potential benefits and key challenges of engaging in trade with the Philippines?

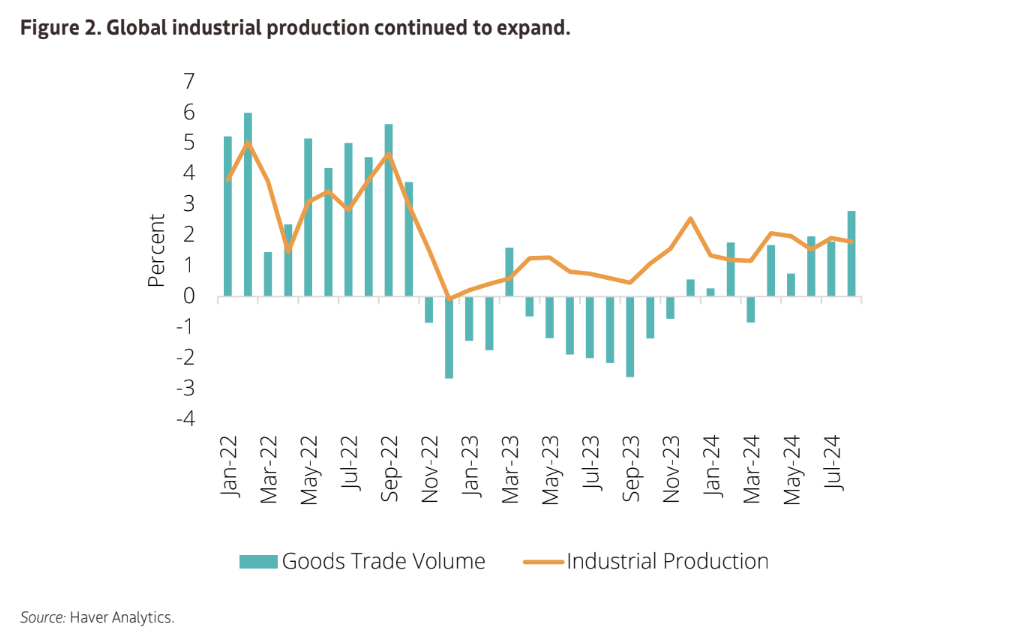

In a February 2025 lecture at the Lee Kuan Yew School of Public Policy, then-NEDA Director General Arsenio Balisacan outlined key challenges affecting trade with the Philippines. These include widening income inequality that fuels political polarisation, lingering global trade tensions from past U.S. tariff policies, the disruptive impact of AI and automation on low-skilled jobs, and the financial strain of transitioning to clean energy. Infrastructure gaps, high power costs, and regulatory complexity continue to hinder trade efficiency, although reforms like the CREATE MORE Act and the PPP Code are helping address these constraints.

Despite these hurdles, the Philippines offers strong trade and investment prospects. With a robust 6.1% GDP growth rate, a young and skilled workforce, and a rapidly expanding middle class, the country is poised to become a trillion-dollar economy within the next decade. Investor confidence is reinforced by sound fiscal management, inflation control, and digital tax reforms. The Philippines’ participation in the EU’s GSP+ scheme provides tariff advantages for over 6,200 products, while its removal from the FATF grey list in February 2025 signals a more secure and investor-friendly environment. Strategic sectors such as BPO, tourism, digital finance, and infrastructure development further position the Philippines as a compelling partner for Singaporean and global businesses seeking sustainable growth in ASEAN.

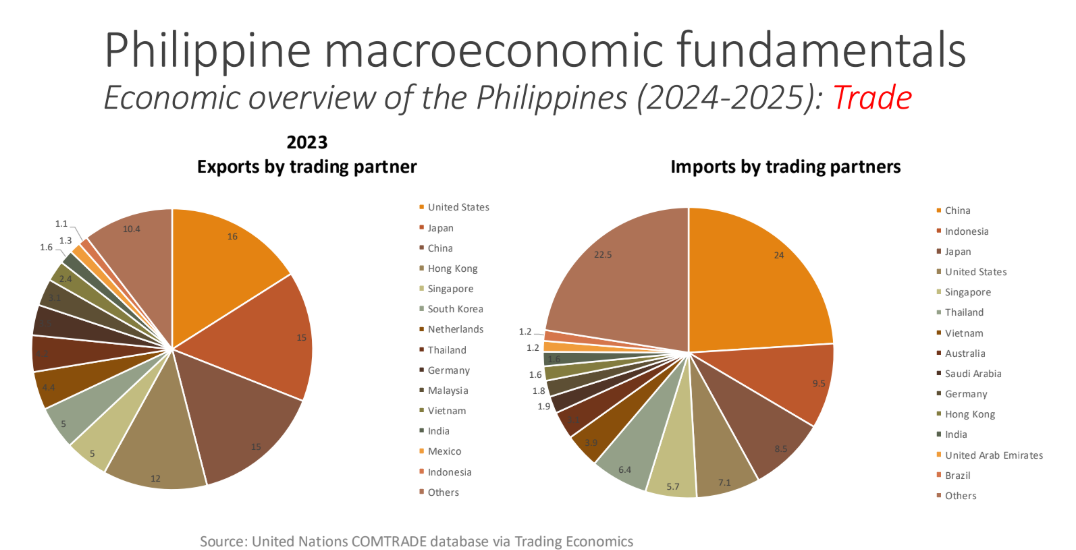

Q: Who are the Philippines’ main trade partners?

According to the Philippine Statistics Authority (PSA), the United States was the country’s top export destination in January 2025, accounting for USD 1.13 billion or 17.7% of total exports. Completing the top five major export trading partners were Japan with USD 945.80 million (14.9%), Hong Kong with USD 722.81 million (11.4%), the People’s Republic of China with USD 645.57 million (10.1%), and Singapore with USD 266.48 million (4.2%).

Q: What types of partnerships are you currently seeking — investment, innovation, education, etc.?

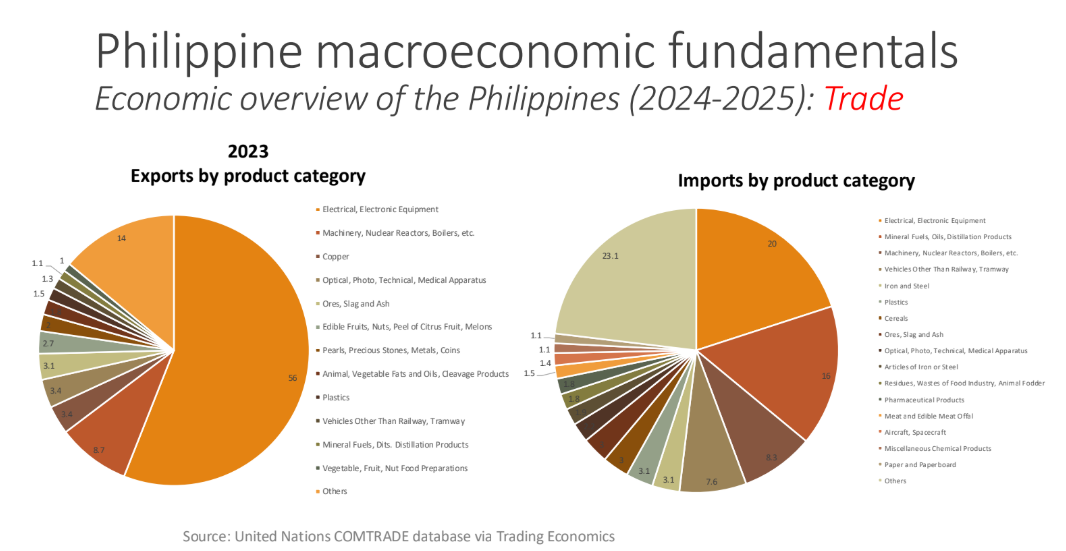

The Philippines actively welcomes investments in priority industries such as aerospace, automotive, copper processing, electronics, IT-BPM, mining, pharmaceuticals, and renewable energy. The government is seeking strategic partnerships to drive inclusive and sustainable growth, with a particular focus on sectors like green energy, advanced manufacturing, infrastructure, and agribusiness. Led by the Department of Trade and Industry (DTI) and Department of Finance (DOF), investment partnerships are encouraged in solar, wind, EV parts, semiconductors, and logistics, among others.

Collaboration in innovation and technology is also a national priority, with efforts steered by the National Economic and Development Authority (NEDA) and DTI. The country is looking to partner on research and development, AI, digital startups, smart cities, and climate resilience technologies. Equally important are cross-agency initiatives in education and workforce development, particularly in STEM, tech-vocational training, and industry-academe linkages to future-proof the labour force.

To support long-term sustainability, the Philippines is fostering ESG-aligned investments, green financing instruments, and carbon trading pilots. Digital economy partnerships are also encouraged, focusing on MSME access to global markets, fintech for financial inclusion, and strengthening digital infrastructure and cybersecurity—all aimed at enhancing the country’s competitiveness in the global digital landscape.

Q: How can Singaporean companies effectively comply with regulations when doing business in the Philippines?

The Philippines welcomes foreign investors with a progressively improving regulatory environment and a wide range of incentives for priority industries. Agencies such as the Board of Investments (BOI) and the Philippine Economic Zone Authority (PEZA) offer structured support, while tools like the BOI Investors’ Guidebook provide clear steps on registration, ownership rules, and incentives. However, for capital-intensive or highly regulated ventures, it remains standard global practice to engage local legal or consulting firms to ensure regulatory compliance and mitigate risks. Government support complements—but does not replace—professional due diligence and legal guidance.

At the 4th Philippine-Singapore Business and Investment Summit (PSBIS) in September 2024, Finance Secretary Ralph G. Recto outlined several reforms aimed at attracting Singaporean investors, most notably the CREATE MORE bill. This pending legislation aims to lower corporate taxes for registered enterprises from 25% to 20%, offer VAT exemptions for exporters, and extend incentives for capital- and labour-intensive projects. Singaporean firms are also encouraged to participate in Public-Private Partnerships (PPPs), with the newly enacted PPP Code streamlining collaboration across 186 flagship infrastructure projects. Opportunities abound in sectors like renewable energy, semiconductors, agribusiness, and smart infrastructure—particularly within the Luzon Economic Corridor—where Singapore’s strengths in aviation, digital technology, and smart city solutions align with Philippine development priorities.

Q: Are Philippine products available on store shelves in Singapore? If so, which items are commonly found?

Filipino products are widely available in Singapore, with major retailers like NTUC FairPrice featuring a dedicated “Taste of the Philippines” section that offers over 60 authentic Filipino food items. For a deeper cultural experience, Lucky Plaza—considered the unofficial hub of the Filipino community—houses a wide variety of Filipino goods, from home essentials to beauty products and community services. The country’s rich culinary heritage is also well represented through numerous Filipino and Filipino-inspired restaurants and food outlets, including popular names like Jollibee, Shakey’s, JT’s Manukan, Andok’s Manok, Potato Corner, and Avocadoria. Additionally, the Philippine Embassy supports a network of Food Trek partners, enhancing both cultural presence and economic diplomacy in Singapore.

Q: Are there Philippine products with low import duties, tariffs, and costs in Singapore that could be scaled up for commercial benefit?

The ASEAN Trade in Goods Agreement (ATIGA) significantly enhances trade between Singapore and the Philippines by eliminating import duties on 99.65% of tariff lines among member states, including Brunei, Indonesia, Malaysia, the Philippines, Singapore, and Thailand. This allows key Philippine exports—such as fresh and processed fruits (bananas, mangoes, dried mangoes), coconut products (VCO, coconut sugar, coconut water), marine goods (dried fish, milkfish, canned tuna), native snacks (banana chips, chicharon, polvoron), and coffee and cacao products—to enter Singapore tariff-free. These goods align well with Singaporean consumer trends, particularly in health, wellness, and specialty markets, making them attractive for retail distribution and niche demand.

Beyond ASEAN, the Philippines’ participation in the EU’s GSP+ offers zero or reduced tariffs on over 6,200 products, including garments, furniture, electronics, and footwear—presenting cost advantages for Singaporean firms exporting to Europe through Philippine partnerships. Similarly, with the reintroduction of tariffs on certain Chinese exports by the U.S., the Philippines is increasingly positioned as a favourable alternative sourcing destination for American buyers, further boosting its strategic appeal in global trade networks.

Q: In what ways can the embassy assist Singaporean companies interested in trading with the Philippines?

We support companies with concrete plans to establish operations in the Philippines, particularly in priority sectors such as semiconductors, electronics, renewable energy, data centres, agribusiness, and pharmaceuticals. Interested firms are encouraged to share their company details and project profiles so we can connect them with the relevant Philippine agencies and investment support mechanisms.

For companies still in the exploratory stage, we offer commercial intelligence on the Philippine economy, business environment, and sector-specific opportunities. While we do not conduct feasibility studies or provide legal advice, we can refer businesses to trusted consulting firms, legal experts, banks, and HR service providers. Additionally, we assist Singapore-based firms in sourcing from the Philippines through business matching, B2B meetings, trade fair participation, and inclusion in official buyer delegations to key industry events.