The Embassy of Indonesia in Singapore shares insights on bilateral trade, product availability, regulatory frameworks, and areas for deeper economic partnership.

SINGAPORE, 27 June 2025 – As part of the IN Diplomacy Trade Talk Series, the Embassy of the Republic of Indonesia in Singapore provided an in-depth overview of Indonesia’s trade structure, evolving regulatory landscape, and key areas of cooperation with Singapore. The interview, facilitated by Sun Media, underscored the dynamic trade flows between the two countries and Indonesia’s broader role as a major player in regional and global commerce.

Q: What are the main products traded between Indonesia and its international partners?

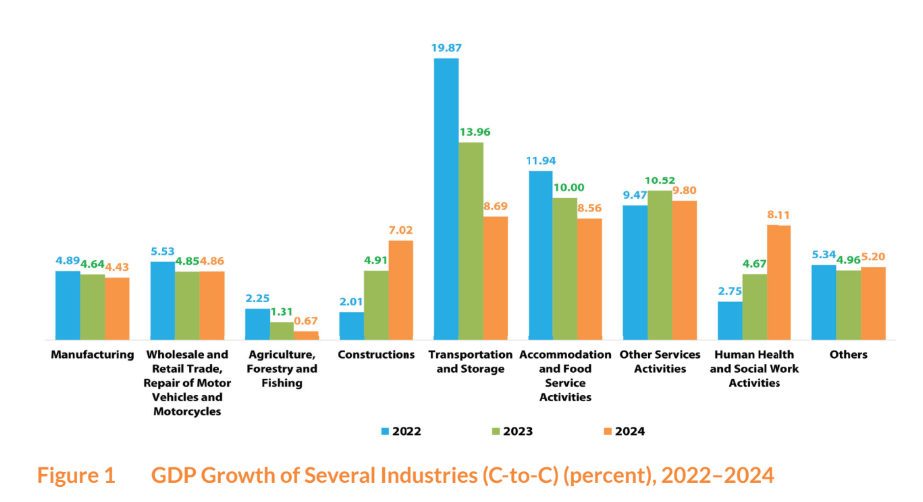

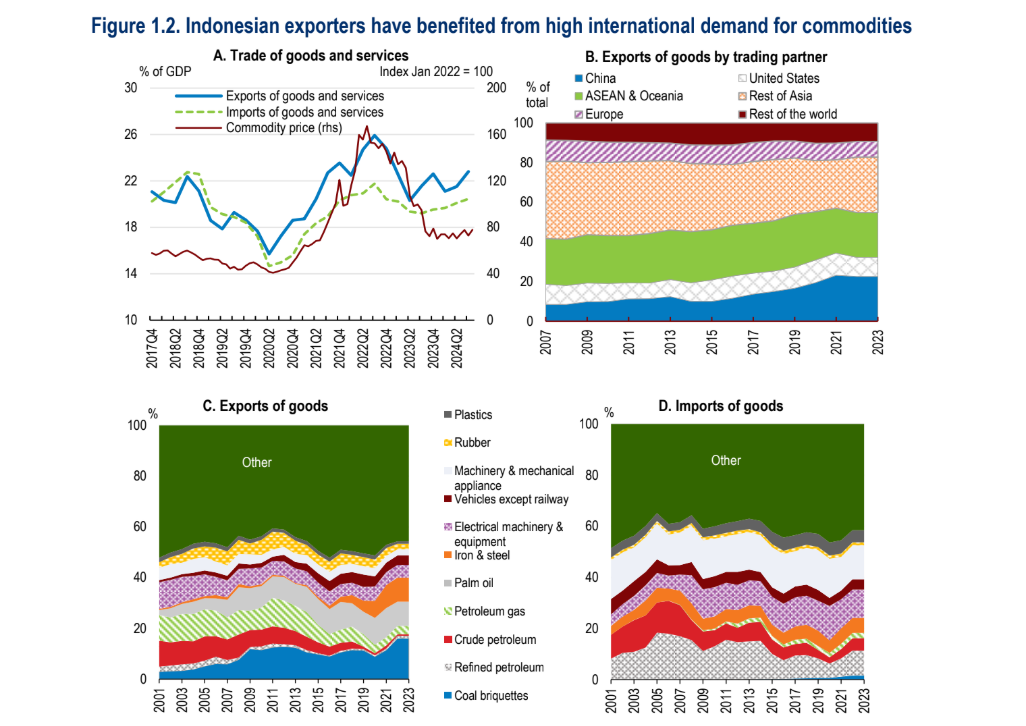

For the past decade, Indonesia has stood as one of the best emerging economies and a commodities powerhouse in global trade. Indonesia’s top exports are dominated by manufacturing goods and natural resources. Indonesia’s exports of manufacturing goods serve as the backbone of its export structure. Some of the notable products include electronic and electrical products, appliances and machinery, steel and stainless-steel products, automotive products, footwear, apparel and clothing products, and rubber products. These exports are complemented by a prominent share of commodities. Mineral fuels such as coal and petroleum accounted for 21% of Indonesia’s export value last year. Palm oil products, another staple export, represented more than 11% of Indonesia’s total exports.

Other emerging commodities include metal products such as iron, copper, and nickel. The export of these products aligns with Indonesia’s key policy of downstreaming in the mineral sector and the effort to integrate strategically into the global manufacturing value chain. In turn, Indonesia’s key imports reflect its development needs. Machinery and equipment, electronics, and refined oil for domestic industries together account for over a quarter of total imports. Other major imports include iron and steel, chemicals, plastics, and food staples such as wheat and sugar, highlighting Indonesia’s ongoing drive to build its industrial base and support a growing population.

Q. Are there any specific regulations or requirements that businesses must be aware of when trading with Indonesia?

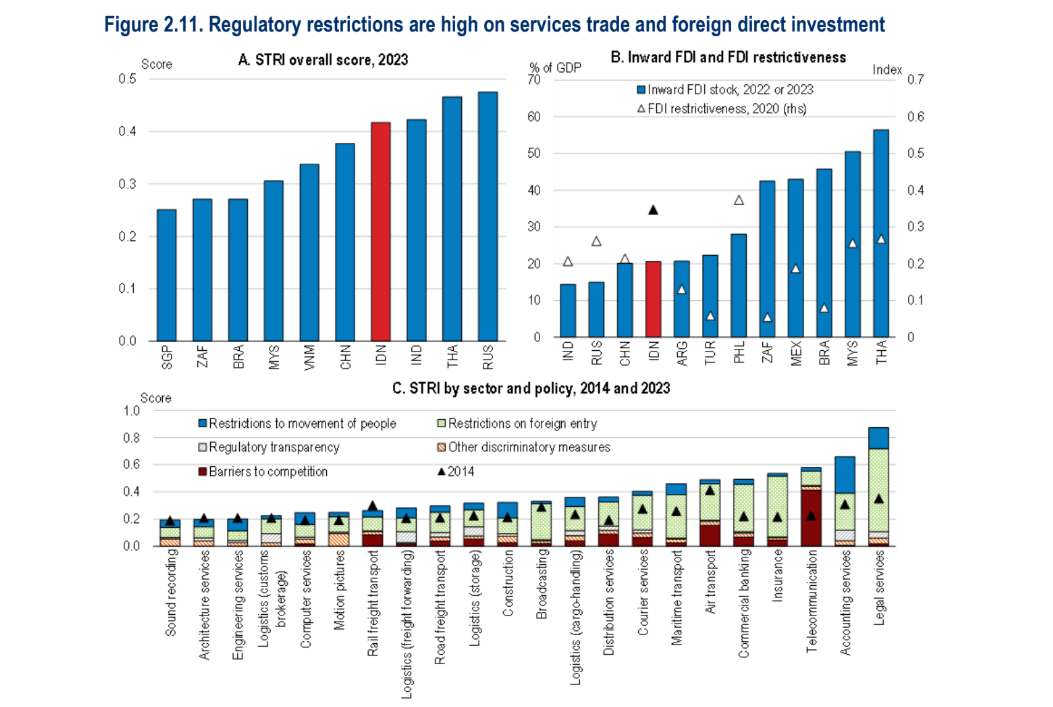

Indonesia has undergone a major transformation in terms of its regulatory framework in the past decade. All the policies and regulations in Indonesia now fully support the ease of doing business. A series of deregulations, simplifications, and the introduction of online-based licensing systems have been fully developed and implemented to cut red tape and ensure easier access for business sectors, while maintaining good governance, accountability, and transparency.

Businesses entering the Indonesian market still need to navigate a few important regulations. For export and import activities, certain fundamental principles and licensing processes must be complied with, particularly for products requiring protection on the basis of consumer safety and health. Products such as food, pharmaceuticals, seeds, and chemicals may require extra permits or testing approvals. In domestic trade, since 2013, Indonesia has imposed labelling and standards regulations. Imported food, beverages, and medicine are required to have labels in Bahasa Indonesia. For non-food manufacturing products, compliance with the Indonesian National Standard (SNI) for safety is also mandatory.

Q. Are Indonesian products available in Singaporean retail outlets? If so, which products are commonly found?

Yes, we are gratefully informed that a wide variety of Indonesian products are readily available in all of Singapore’s retail outlets. Perhaps the most popular example is Indomie instant noodles, a household-name Indonesian brand that stocks the shelves of major Singapore supermarkets. Alongside these, Singaporean grocery stores carry Indonesian spices, sauces, and condiments like sweet soy sauce (kecap manis), chilli paste, snacks, and beverages. Teh Botol, mineral water, and other flavoured drinks from Indonesia are also well-loved by local consumers.

Singapore also imports a large selection of fresh products from Indonesia. In both major retailers and traditional markets, it is easy to find Indonesian seafood, including fish, crabs, and shrimp. Since 2023, Indonesia has successfully gained full market access for poultry exports to Singapore, covering live, chilled, and frozen chicken, as well as fresh eggs. These products are now widely available in Singapore’s retail chains. In addition, fresh bananas, mangosteens, pineapples, leafy greens, tomatoes, edamame, and other fruits and vegetables from Indonesia are distributed daily. Indonesian coffee beans (from Java, Sumatra, and Toraja), snack foods, and artisanal goods such as batik textiles and handcrafted furniture are also available, showcasing the strong cultural and commercial ties between both nations.

Q. Which Singaporean products would you like to see more of in the Indonesian market?

Indonesia is interested in seeing more Singaporean goods and services that align with Indonesia’s development goals. In terms of sectors, Indonesia is looking for more of Singapore’s knowledge-intensive and innovative products—particularly in green energy and digital innovation—to support the nation’s growth trajectory. Singapore is known for its urban green energy technology, and Indonesia would welcome greater availability of solar panels, waste-to-energy systems, and energy-efficient infrastructure tools to accelerate the shift toward renewable energy and low-carbon growth.

Similarly, Singapore’s leadership in the digital economy—ranging from fintech platforms and digital payment systems to smart city solutions—is highly regarded. Expanding these services into the Indonesian market could support broader goals like financial inclusion and better urban management. Indonesia’s growing middle class is also driving demand for high-quality healthcare and pharmaceutical products, educational services, and premium lifestyle goods, all of which Singapore is well-positioned to provide.

Q. What are the key benefits and challenges of doing trade with Indonesia?

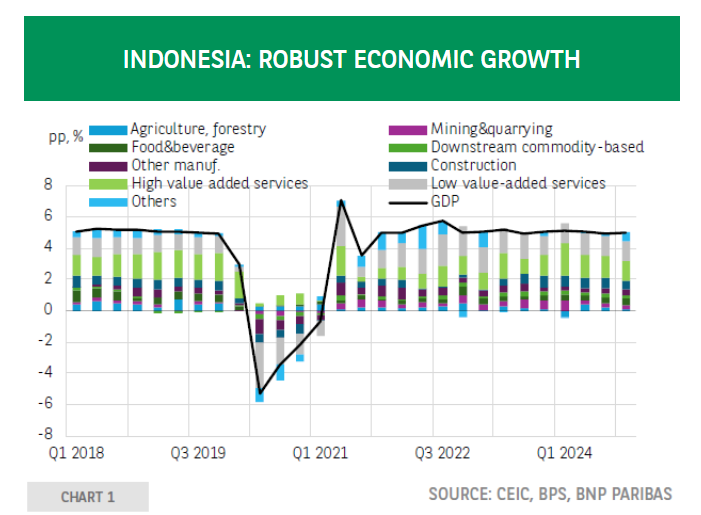

Engaging in trade with Indonesia offers significant benefits, but of course, it also comes with a few challenges that businesses must navigate. On the benefit side, Indonesia provides access to a large and growing domestic market. With over 280 million people, Indonesia is Southeast Asia’s largest economy and one of the world’s fastest-growing emerging markets, achieving average annual growth rates above 5% in recent years. Its expanding middle class is driving increased demand for imported goods, both consumer and capital-related. In addition, Indonesia is rich in natural resources, offering international businesses competitive access to commodities like energy, minerals, and agricultural products. Its central location within ASEAN also makes it a strategic base for regional trade.

Indonesia’s industrial sector presents further opportunities for businesses to manufacture locally. With the Omnibus Law now in effect, there is greater certainty and flexibility for foreign investors operating in the country. A relatively skilled workforce and reformed labour regulations also support productive industrial output. On the logistics front, government-led reforms—especially the implementation of the National Logistics Ecosystem (NLE)—are aimed at improving efficiency and reducing operational costs. At the regional level, Indonesia is a member of 37 free trade agreements (FTAs), including the ASEAN Free Trade Area (AFTA) and the Regional Comprehensive Economic Partnership (RCEP). However, businesses must be prepared to navigate regulatory complexities and market nuances. Understanding Indonesia’s diverse local markets, building strong partnerships, and ensuring administrative compliance are essential for success.

Q. How can companies in Singapore connect with potential business partners or contacts in Indonesia?

Singaporean companies can go plenty of ways to connect with potential partners and contacts in Indonesia, leveraging both government support and private networks. Of course, all Singaporean businesses are more than welcome to seek more information from the Indonesian Embassy in Singapore. The Embassy maintains close collaboration with Singaporean agencies like Enterprise Singapore, the Ministry of Trade and Industry (MTI), and the Singapore Food Agency (SFA). These organisations offer market insights, facilitate business matching, and help Singaporean companies connect with vetted Indonesian partners.

Beyond official channels, businesses can also tap into industry associations such as the Singapore Business Federation (SBF), Singapore Manufacturing Federation (SMF), and Indonesia’s Chamber of Commerce and Industry (KADIN). These bodies frequently organise trade missions and networking events. Participation in major trade fairs, such as the annual Trade Expo Indonesia or other sector-specific exhibitions across Indonesian cities, is another effective avenue. Furthermore, engaging with consultants, B2B platforms, and professional networks is a recommended approach. Relationship-building is critical in Indonesia’s business culture, so companies are advised to invest time in visiting the country, meeting partners face-to-face, and building trust.

Q. In what ways can the Indonesian Embassy support Singaporean businesses interested in trading with Indonesia?

In recent years, the Embassy of the Republic of Indonesia in Singapore has been very active in promoting trade, tourism, and investment sectors to Singapore audiences, acting as a bridge to strengthen bilateral ties. It offers support in multiple ways. The Embassy is structured with four main departments, including Economy and Education, and it is staffed by 13 technical attachés covering areas such as Trade, Investment, Legal Affairs, Immigration, and Labour. These departments provide assistance and guidance for Singaporean businesses to learn more about Indonesia’s policies, regulations, and opportunities.

The Embassy’s Trade Attaché and Indonesian Investment Promotion Centre (IIPC) regularly organise and facilitate business forums, networking events, and market update briefings, such as the quarterly Indonesia Update Forum. These events are often held in collaboration with Singaporean business associations and educational institutions. The Embassy also arranges business missions to Indonesia, helping companies meet with potential local partners and relevant government agencies. In addition to market intelligence, it provides practical support, including guidance on business visa applications, regulatory clarification, and facilitation of initial communications with Indonesian ministries or local authorities.

Q: Which Indonesian products offer tariff or cost advantages for Singaporean importers under current or future trade agreements?

Singaporean importers enjoy significant tariff advantages when sourcing Indonesian products, thanks to ASEAN’s free trade regime and newer agreements like the Regional Comprehensive Economic Partnership (RCEP). Within ASEAN, nearly all goods traded intra-regionally are duty-free, as the ASEAN Trade in Goods Agreement (ATIGA) has eliminated tariffs on around 90% of product categories among the major economies since 2010. This means that a wide range of Indonesian products—from palm oil and coffee to garments and electronics—can enter Singapore without import duties. Given Singapore’s own low-tariff structure, this ensures Indonesian goods remain highly competitive in the local market.

The RCEP, in force since 2022–2023, further enhances this advantage. With 15 Asia-Pacific member countries, it will eventually eliminate 92% of tariffs on traded goods. While some of RCEP’s benefits to Singapore importers are indirect, they are substantial—lower tariffs for Indonesian goods in third markets like China or Japan make regional supply chains more attractive. Singapore-based traders can source from Indonesia and re-export under favourable conditions. The agreement also simplifies rules of origin, making it easier for firms to count Indonesian components in regional exports. Future trade initiatives, including Indonesia’s accession to the CPTPP and a proposed EU-Indonesia FTA, are expected to offer even broader tariff incentives for bilateral trade.

Q. What types of partnerships is Indonesia currently seeking, for example, in areas such as investment, innovation, or education?

Indonesia is actively seeking a broad range of international partnerships to support its national development agenda, which currently focuses on areas such as trade, investment, energy, technology, and education, particularly in strategic sectors like agriculture, green energy, and the digital economy. In investment, Indonesia welcomes foreign involvement in infrastructure, renewable energy, manufacturing, and downstream industries. The government sees foreign direct investment (FDI) as critical to enhancing domestic capacity and productivity. With a young, tech-savvy population and a growing startup ecosystem, Indonesia is also open to partnerships in innovation sectors, especially fintech, e-commerce, cybersecurity, and artificial intelligence.

Green energy and sustainability are another top priority. Indonesia aims to increase renewable energy adoption and reduce emissions, and it looks to Singapore and other partners for both technological and financial collaboration, whether in solar, wind, geothermal projects, or carbon capture and storage. The government is also focused on food security and seeks agri-tech partnerships to modernise its agricultural systems. Recent MOUs with Singapore on food safety and farming innovation, including a “Young Farmers” exchange programme, reflect this goal. In the education sector, Indonesia is pushing for more academic cooperation, vocational training, and research linkages. The Youth Mobility Programme with Singapore, which enables student exchanges and internships, represents a step toward globalising Indonesia’s workforce and enriching cross-border knowledge-sharing.