The High Commission of India in Singapore and ICAI Singapore Chapter convened stakeholders to discuss the next generation of GST reforms and their impact on business and trade

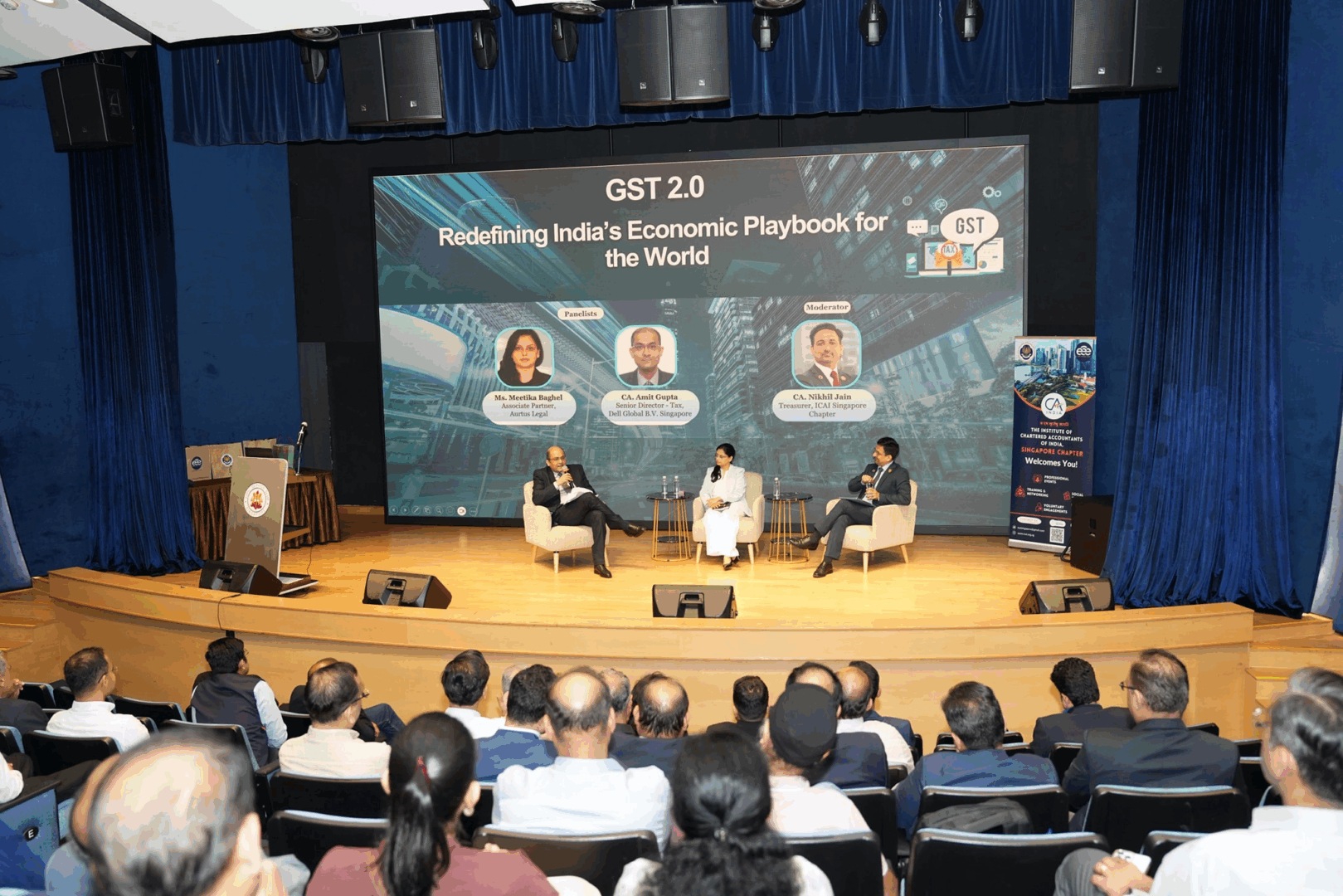

The High Commission of India in Singapore, together with the Institute of Chartered Accountants of India (ICAI) Singapore Chapter, organised a discussion on “GST 2.0: Redefining India’s Economic Playbook for the World.” The event brought together business leaders, financial experts, and members of the Indian diaspora to explore the implications of the next generation of Goods and Services Tax (GST) reforms.

Image by Indian High Commission in Singapore

The High Commissioner of India to Singapore highlighted the importance of GST reforms in driving India’s domestic consumption while also strengthening bilateral economic engagement. He emphasised that the reform process was designed to simplify compliance, promote transparency, and create a more robust foundation for long-term economic growth.

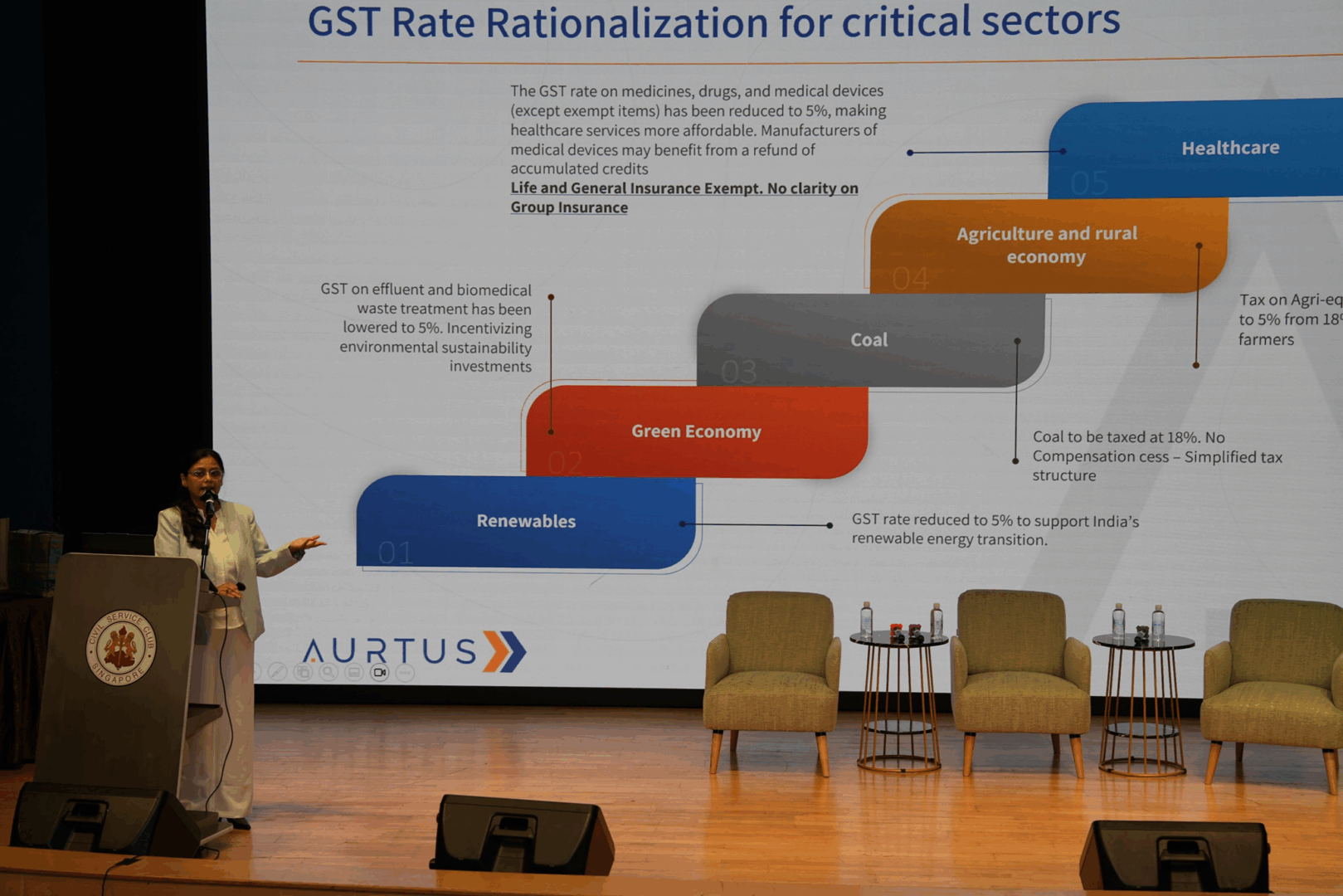

Experts from ICAI and the wider financial sector provided in-depth insights into the pillars of GST 2.0. Key areas of discussion included rate rationalisation, its effects on diverse industry sectors, and how these measures would contribute to improving the ease of doing business in India. Speakers noted that these reforms were also expected to enhance India’s global competitiveness by making its taxation system more efficient and business-friendly.

The session underscored the collaborative role of stakeholders in implementing GST reforms effectively and reaffirmed India’s commitment to creating a predictable, transparent, and globally aligned tax system. Participants also discussed how the reforms could open new opportunities for cross-border trade and investment, further strengthening India–Singapore economic ties.

Source: India High Commission in Singapore