Image by Singapore FinTech Festival

At the 10th edition of the Singapore FinTech Festival (SFF) 2025, MAS Managing Director Mr Chia Der Jiun outlined a forward-looking roadmap for the financial sector, unveiling new initiatives in artificial intelligence (AI), tokenisation, and digital currency innovation

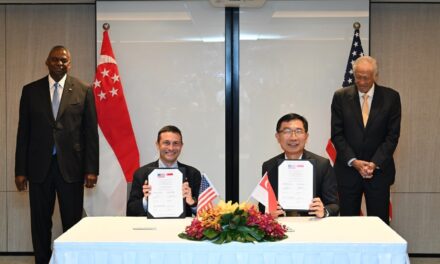

Singapore, 13 November 2025 — The Monetary Authority of Singapore (MAS) marked a major milestone at the 10th Singapore FinTech Festival (SFF) as Managing Director Mr Chia Der Jiun delivered his keynote remarks titled “Creating the Future of Finance: A Journey of Innovation and Collaboration.” Reflecting on a decade of progress, he noted how the event has grown from 11,000 participants and 70 exhibitors in 2016 to over 65,000 participants and 600 exhibitors this year — a testament to the nation’s thriving FinTech ecosystem.

Mr Chia credited the “FinTech innovators, forward-thinking financial institutions and global tech companies” for driving Singapore’s transformation into a global FinTech hub. He highlighted how MAS’ approach over the years — combining regulatory flexibility with innovation support — has nurtured a vibrant sector of more than 1,800 FinTech firms. These firms have advanced new business models, from robo-advisors and digital banks to AI-powered fraud detection and multi-lingual chatbots.

SFF2025 | Creating the Future of Finance: A Journey of Innovation and Collaboration

Image by Singapore FinTech Festival

Looking ahead, Mr Chia identified AI and tokenisation as the twin forces shaping the next decade of financial innovation. On AI, MAS announced several new initiatives, including BuildFin.ai, which will bring together technology providers, research institutes and financial institutions to co-develop advanced AI solutions. One early project involves a partnership with A*STAR to create a Voice-to-Text AI model capable of transcribing conversations in Singlish and local dialects.

To strengthen responsible AI adoption, MAS published for consultation a new set of Guidelines on AI Risk Management. The proposed guidelines outline expectations for financial institutions to identify and control AI risks across their lifecycle. “The Guidelines will be principles-based rather than prescriptive. It sets up flexible guardrails to enable responsible innovation in a fast-moving space,” Mr Chia said. Complementing this, an AI Risk Management Executive Handbook has been launched to provide industry good practices and actionable insights.

MAS also announced a successful live trial of interbank overnight lending settlement using wholesale Central Bank Digital Currency (CBDC). The trial, conducted with DBS, OCBC, and UOB on the Singapore Dollar Test Network, marks the first live issuance of Singapore dollar wholesale CBDC. MAS stated that this initiative demonstrates how tokenised financial assets can be securely settled in real-time, paving the way for future trials, including the issuance of tokenised MAS Bills.

Concluding his remarks, Mr Chia likened the growth of AI and tokenisation to the building of great networks: “AI too can bring benefits across the financial sector… but there needs to be governance and guardrails for safe adoption.” He urged continued collaboration between the public and private sectors to build “an interconnected system of standardised asset-backed tokens and interoperable networks,” ensuring that the future of finance is both innovative and trusted.