Mr. Ravi Menon, Managing Director of the Monetary Authority of Singapore, delivered an engaging speech at the Inclusive FinTech Forum held in Rwanda, highlighting the transformative potential of FinTech, the importance of collaboration, and the need to use technology to improve people’s lives.

In an engaging and insightful address at the Inclusive FinTech Forum, Mr Ravi Menon, the Managing Director of the Monetary Authority of Singapore, highlighted the theme of “Enabling FinTech for Good” and emphasized the importance of collaboration between Africa and Asia. With esteemed leaders such as President Paul Kagame of Rwanda and President Hakainde Hichilema of Zambia in attendance, the event aimed to explore the transformative potential of financial technology and its positive impact on society.

Mr Menon expressed his delight at being part of the session, emphasizing Singapore’s pride in contributing to the global effort of utilizing FinTech for the betterment of society. He commended the energy and vitality observed in the host country, highlighting the remarkable progress made in Africa. Recognizing the transformative power of technology in the financial sector, he stressed the need to balance opportunities and risks associated with FinTech.

Drawing from Singapore’s own experience, Mr Menon shared the four guiding principles that have shaped their FinTech journey over the past eight years. These principles revolve around enhancing efficiency, managing risks, creating new opportunities, and most importantly, improving people’s lives. These principles continue to guide Singapore’s efforts and offer valuable insights for others seeking to leverage FinTech for positive change.

Identifying two critical enablers of their success, Mr Menon emphasized the importance of foundational digital infrastructure and fostering connectivity and collaboration. He highlighted Singapore’s approach to building digital infrastructure, including the introduction of Singpass as a digital identity, the development of PayNow for interoperable electronic payments, and the establishment of MyInfo as a trusted data exchange platform.

Connectivity and collaboration across borders were identified as the second crucial enabler. Mr Menon discussed the significance of cross-border payments connectivity, sharing examples of Singapore’s successful integration with Thailand’s PromptPay and India’s Unified Payments Interface. He expressed hope for similar collaborations with African countries in the future. Additionally, he stressed the importance of human collaboration and face-to-face engagements, citing the Singapore FinTech Festival as a prime example.

Closing his remarks, Mr Menon emphasized the need for FinTech to serve a larger purpose and solve real-world problems. He highlighted the unique opportunity for Africa to leapfrog legacy systems and vested interests, building a modern digital economy and society from the ground up. Encouraging collaboration between innovators, investors, business leaders, and policymakers, he envisioned a future where technology and finance converge to create a prosperous, vibrant, and inclusive Africa.

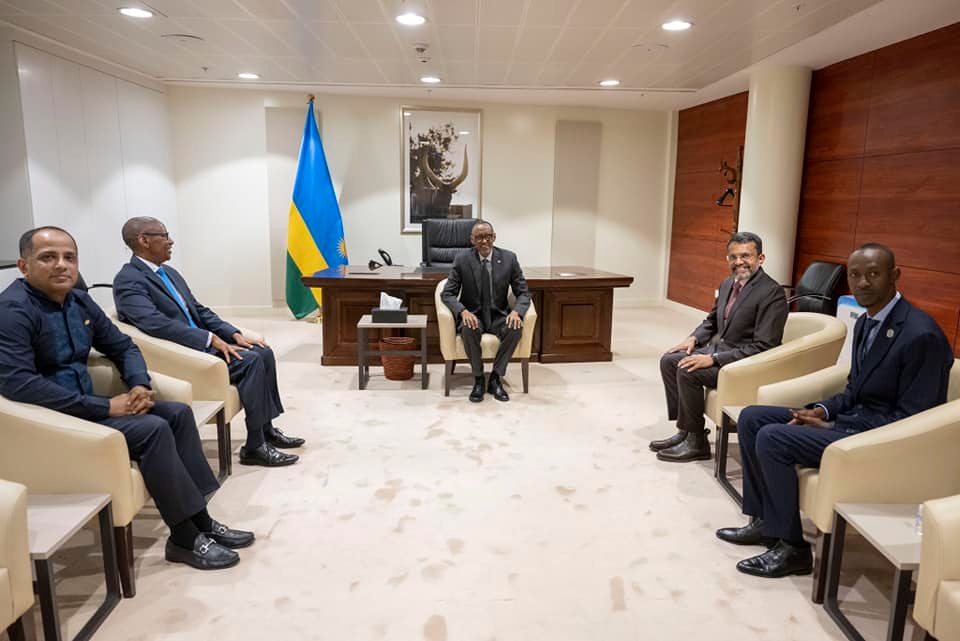

Following the event, President Kagame met with, Ravi Menon, Managing Director of the co-host of #IFF2023, the Monetary Authority of Singapore, for discussions on ways to promote a more sustainable approach to financial inclusion.

Mr Menon and his wife also had the opportunity to visit the Nyandungu Eco-Park, a beautiful natural attraction in Rwanda. The visit provided a memorable experience for the esteemed delegation, highlighting the country’s commitment to sustainable development and environmental conservation.

The Inclusive FinTech Forum, with its focus on leveraging technology for positive change and fostering collaboration between continents, sets the stage for a promising future where FinTech becomes a powerful tool for inclusive growth, economic prosperity, and social advancement.