Singapore-based Olam Group has announced the sale of its remaining 64.57% stake in Olam Agri to Saudi Agricultural & Livestock Investment Company (SALIC) in a two-phase deal worth $2.58 billion.

Singapore, February 24, 2025 – Olam Group Limited (OGL) has entered into an agreement to sell its remaining 64.57% stake in Olam Agri to Saudi Agricultural & Livestock Investment Company (SALIC) for approximately $2.58 billion (S$3.41 billion³). The sale will be executed in two tranches, further strengthening SALIC’s control over Olam Agri.

In Tranche 1, SALIC will acquire 44.58% of Olam Agri for approximately $1.78 billion (S$2.35 billion³). Upon completion of this tranche, SALIC will increase its stake to 80.01%, giving it majority control over the company.

In Tranche 2, Olam Group will have a put option¹ to sell its remaining 19.99% stake to SALIC at the end of three years at the Closing Valuation² plus 6% IRR. At the same time, SALIC will have a call option to acquire this stake at the same terms before the third anniversary of Tranche 1’s completion.

The deal values Olam Agri at $4.00 billion (S$5.28 billion³), which is 23% higher than Olam Group’s current market capitalization⁴. This valuation is also 14% above the previous valuation when SALIC first acquired a 35.43% stake in December 2022.

Olam Group expects to realize a gain of $1.84 billion (S$2.43 billion³) from Tranche 1⁵. The total cash proceeds from Tranche 1 and 2 are expected to be $2.58 billion (S$3.41 billion³).

The full divestment of Olam Agri, including the 35.43% stake sale in 2022, will generate $3.87 billion (S$5.11 billion³) in total gross proceeds. This transaction represents a major value realization for Olam Group’s shareholders.

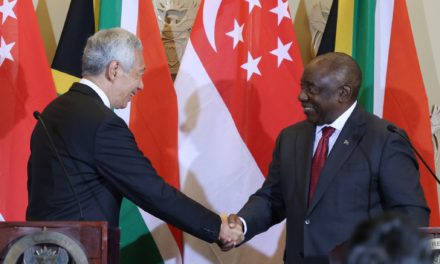

Olam Group’s CEO, Sunny Verghese, described the sale as a significant milestone in Olam’s Re-organisation Plan, which was announced in January 2020. With this deal, Olam will focus on unlocking value in its remaining businesses, including ofi (Olam Food Ingredients) and the Remaining Olam Group, with a potential ofi IPO under consideration.

SALIC’s CEO, Sulaiman AlRumaih, emphasized that acquiring full ownership of Olam Agri aligns with Saudi Arabia’s food security strategy. The deal strengthens SALIC’s presence in global agricultural supply chains and enhances its ability to diversify essential commodity sources.

Olam Agri is a major player in global agribusiness, with 39 million metric tonnes in volumes and S$31.3 billion in revenue generated in 2023. Under SALIC’s ownership, the company will continue to play a vital role in global food security and agribusiness trade.

The completion of Tranche 1 is subject to shareholder approval and regulatory clearances and is expected to be finalized by Q4 2025.

Additionally, Olam Agri will distribute a dividend of up to $110 million based on its full-year 2024 performance.

After Tranche 2, SALIC will become the full owner of Olam Agri, while Olam Group will shift its focus to maximizing value in its remaining businesses.

Source: Olam