The Royal Embassy of Cambodia in Singapore outlines regulatory frameworks, economic potential, and collaborative opportunities for Singaporean businesses.

SINGAPORE, 30 June 2025 – As part of the IN Diplomacy Trade Talk Series, the Royal Embassy of Cambodia in Singapore participated in an interview with IN Diplomacy to discuss the current trade environment, opportunities, and bilateral relations between Cambodia and Singapore.

Q: Are there any particular regulations or compliance requirements for importing or exporting to and from your country?

Of course, Cambodia has specific regulations and compliance requirements for importing and exporting goods, governed primarily by the Law on Customs, the Law on Management of Quality and Safety of Products and Services, and related sub-decrees and prakas (ministerial decisions). All imported goods must be declared to the General Department of Customs and Excise (GDCE), under the Ministry of Economy and Finance. Importers are subject to duties and taxes ranging from 0% to 35%, along with 10% VAT and special taxes for goods such as alcohol, tobacco, and fuel. In some cases, import licences or authorisations from line ministries are required, such as from the Ministry of Health or the Ministry of Agriculture, Forestry and Fisheries.

To ensure product quality and safety, goods must meet standards overseen by the Institute of Standards of Cambodia (ISC), and some require pre-shipment inspection and laboratory testing. Sanitary and phytosanitary (SPS) measures apply to food and agriculture imports. Exporters must register with the Ministry of Commerce, and depending on the goods, obtain necessary export licences and Certificates of Origin (COs) for preferential access under FTAs like ASEAN-China and RCEP.

Q: What are the advantages and challenges of trading with Cambodia?

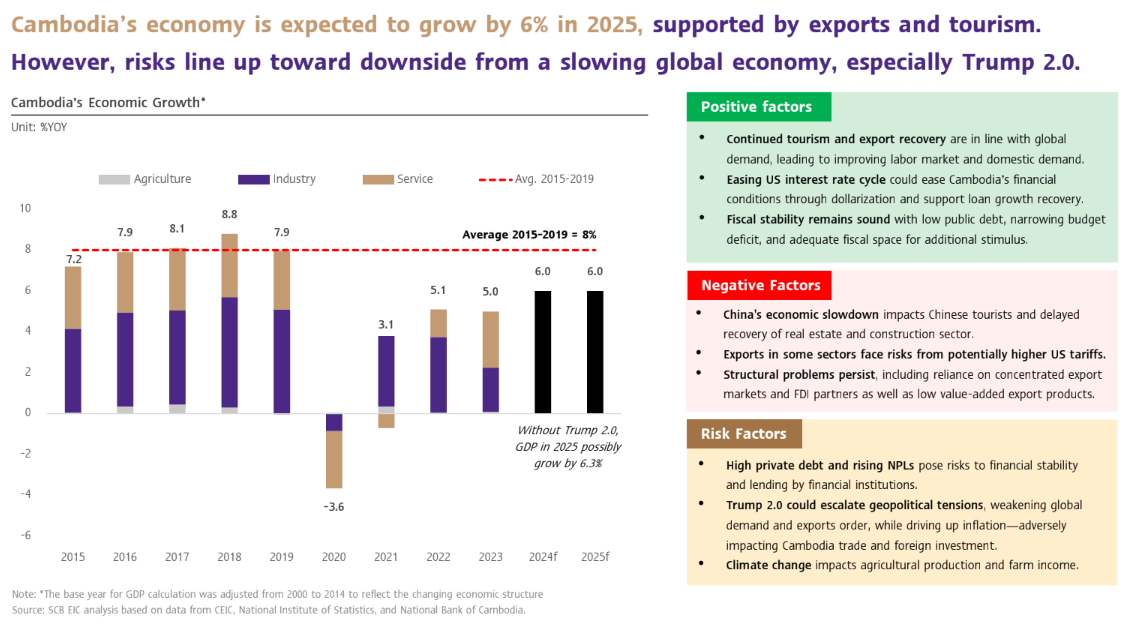

Cambodia offers a peaceful and stable political environment with a pro-business government, and is recognised as one of the fastest-growing emerging markets. With macroeconomic stability, low inflation, and a growing middle-income population, the country is on track to graduate from Least Developed Country status by 2029. The business environment is liberal, offering 100% foreign ownership, profit repatriation, tax holidays of up to 9 years, and duty exemptions under the new investment law.

Strategically located in Southeast Asia, Cambodia provides access to regional and global markets through its participation in multiple FTAs, including those with China, Korea, the UAE, and ASEAN. A young, dynamic workforce, lower wage costs, and vocational training programs further support manufacturing and investment. Ongoing infrastructure developments, such as new airports, expressways, seaports and digital payment systems, improve logistics and connectivity. While there are challenges like navigating bureaucracy, the government’s one-window service and regular public-private forums aim to address business concerns efficiently.

Q: What are the currently traded goods or services between Singapore and your country?

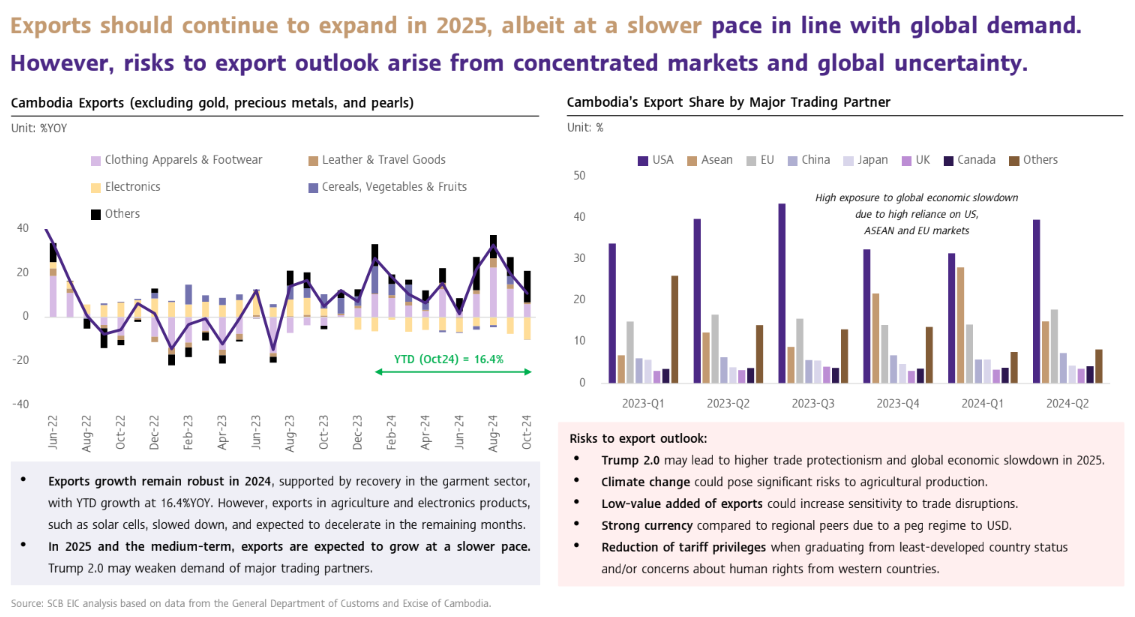

Trade between Cambodia and Singapore has grown steadily. In 2024, bilateral trade reached USD 4.83 billion, a 7.19% increase from 2023. From January to May 2025 alone, trade has already reached USD 1.46 billion. Cambodia’s exports to Singapore include natural or cultured pearls, rubber, leather articles, garments and clothing accessories, footwear, rice, machinery, beverages, and electrical equipment.

On the import side, Cambodia mainly receives mineral fuels, oils, plastics, edible preparations, vehicles, tanning extracts, and various machinery from Singapore. This bilateral trade reflects Cambodia’s expanding industrial base and Singapore’s role as a supplier of high-value and processed goods.

Q: Could Singapore serve as a hub or supply chain gateway for your products to the ASEAN or Asia-Pacific markets?

Singapore is well-positioned to serve as a hub for Cambodian products, offering advanced logistics, world-class infrastructure, and proximity to major Asia-Pacific markets. Its port is among the busiest globally, and the country hosts many multinational logistics firms, enabling efficient supply chain management.

Cambodian producers can benefit from Singapore’s streamlined distribution networks to reach broader regional and global markets. With the presence of high-quality warehousing, cold-chain systems, and digital trade platforms, Cambodian goods—particularly agricultural and light manufacturing products—can expand into ASEAN and beyond through Singaporean partnerships.

Q: Are there any trade promotion programs or initiatives that can facilitate trade between Cambodia and Singapore?

Yes, Cambodia actively promotes trade through bilateral agreements and initiatives aimed at strengthening private sector collaboration. A key initiative is the Avoidance of Double Taxation Agreement (DTA) signed between Cambodia and Singapore, which enhances investor confidence and supports cross-border economic activity. The Government-Private Sector Forum, convened regularly, allows business communities to voice challenges directly to the Prime Minister and ministries for resolution and policy improvement.

Other efforts include the June 2024 MoU between the Singapore Business Federation and the Cambodia Chamber of Commerce to deepen business collaboration. Enterprise Singapore offers support for Singapore firms expanding into Cambodia. The Financial Transparency Corridor (FTC), launched by the National Bank of Cambodia and the Monetary Authority of Singapore, enables SME-level trade financing through secure digital data exchange. The Cambodia-Singapore Cooperation Centre (CSCC) further provides technical capacity-building to support long-term trade facilitation.

Q: How does the embassy support companies from Singapore or other countries interested in doing business with yours?

As you are already aware, the Cambodian Embassy in Singapore plays a proactive role in facilitating foreign business engagement. Under the country’s Economic Diplomacy Strategy launched in 2021, the Embassy acts as a first point of contact for investors, providing updated information on investment laws, priority sectors, and government incentives. It also assists with navigating regulations, supporting market research, and promoting product visibility.

Beyond this, the Embassy organises business networking events, facilitates introductions to relevant Cambodian agencies, and coordinates business matching sessions. It also promotes Cambodia’s economic appeal through trade events, cultural forums, and by offering advisory services for Singaporean businesses interested in entering or expanding within Cambodia.

Q: What are the key Cambodian goods that present tariff and cost advantages for Singapore’s importers under existing or future trade agreements?

Cambodia’s exports offer clear tariff and cost advantages under ASEAN’s Trade in Goods Agreement (ATIGA) and the Regional Comprehensive Economic Partnership (RCEP). These include zero tariffs on nearly all traded goods between Cambodia and Singapore, and preferential rules of origin under RCEP that benefit supply chain integration.

Key Cambodian products include high-quality rice, particularly fragrant jasmine rice, cashew nuts, and a variety of tropical fruits. Apparel, footwear, travel goods, and light-manufactured products like bicycles and electronics components also benefit from duty-free access. Singaporean importers can source these goods at competitive prices while enjoying simplified customs procedures and preferential tariffs.

Q: What kinds of products from your country are you actively looking to introduce into new markets?

Cambodia is actively diversifying its export portfolio under its Trade Integration Strategy and national development plans. Top priorities include agricultural products such as fragrant and organic rice, edible bird’s nest, processed fruits (e.g., mangoes, bananas, durians), and geographical indication products like Kampot pepper and palm sugar.

Other targeted sectors include light manufacturing such as solar panels, bicycles, and electronics parts, as well as footwear, leather goods, and travel accessories. These value-added products are part of Cambodia’s drive to move up the global value chain and reach high-growth markets across Asia and beyond.

Q: What would be your recommendations to Singaporean (or foreign) companies looking to establish a presence in your country?

We recommend that foreign investors target Cambodia’s priority sectors such as agro-processing, electronics, renewable energy, digital technology, logistics, and tourism. These are supported by fiscal incentives, including long tax holidays, duty exemptions, and 100% foreign ownership under the Investment Law of 2021.

Companies should also take full advantage of Cambodia’s participation in regional and bilateral trade agreements, including AFTA, RCEP, and FTAs with China, Korea, and the UAE. For official support, investors can engage with the Ministry of Commerce for licensing and with the Council for the Development of Cambodia (CDC) for one-stop investment services and approvals.