In an exclusive IN Diplomacy Trade Talk interview, the Royal Thai Embassy in Singapore highlights key export sectors, trade agreements, and partnership opportunities to deepen Singapore–Thailand economic collaboration.

Singapore, 15 May 2025 – As part of the IN Diplomacy Trade Talk Series, Her Excellency Ureerat Chareontoh, Ambassador of Thailand to Singapore, shared key insights into Thailand’s trade performance, strategic sectors, and initiatives aimed at enhancing economic ties between Thailand and Singapore. The interview was conducted under the backdrop of a robust and evolving bilateral relationship spanning six decades.

What are the top traded items between Thailand and other countries?

Thailand’s key exports include automobiles and auto parts, electronics and electrical appliances, processed food, rubber products, and petrochemicals. In 2024, the country’s total exports reached a record US$300.76 billion, with the top categories being electrical machinery and equipment (US$51.1 billion), machinery including computers (US$47.6 billion), vehicles (US$33.6 billion), rubber and rubber articles (US$19.2 billion), gems and precious metals (US$18.3 billion), plastics (US$13.3 billion), mineral fuels including oil (US$10.2 billion), meat and seafood preparations (US$7 billion), and fruits and nuts (US$6.6 billion).

On the import side, Thailand recorded US$307.56 billion in 2024. Major imports included crude oil, electronic components, machinery, and chemicals, reflecting the country’s integration into global production and supply chains.

What kind of partnerships is your country seeking — investment, technology transfer, education, etc.?

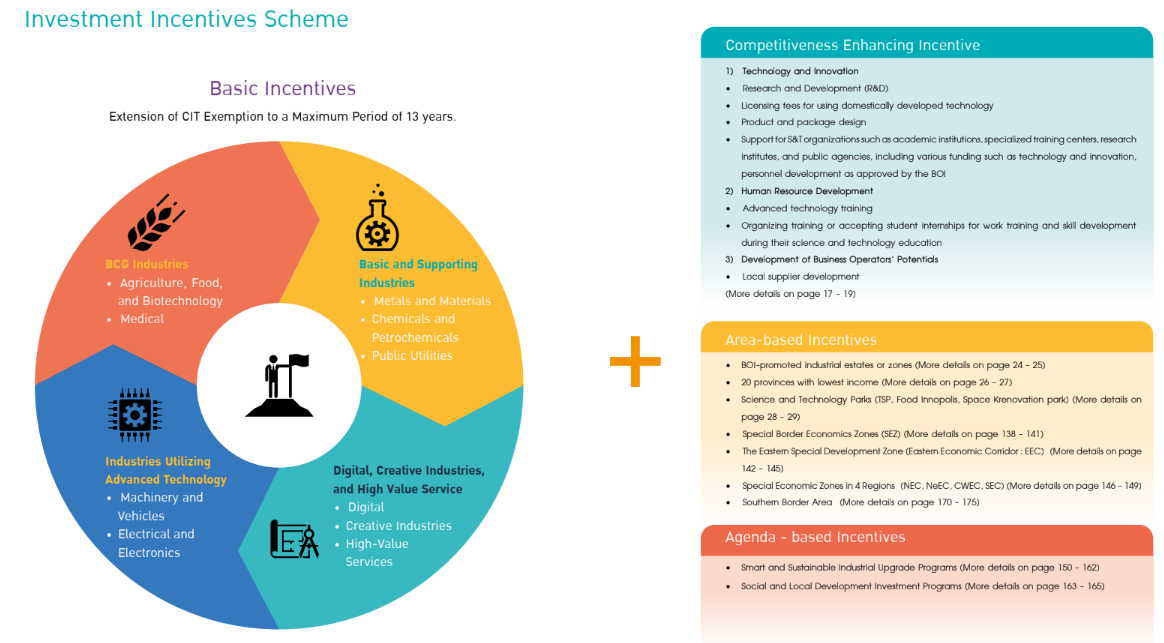

Thailand is open to diverse forms of partnerships, particularly in investment, digital transformation, clean and green technologies, innovation, human capital development, and education. We also encourage collaborations that contribute to sustainable growth and align with Thailand’s Bio-Circular-Green (BCG) economic model.

In 2024, Thailand saw a significant increase in investment applications, reaching a 10-year high with a total of 1.14 trillion baht (approximately US$32.8 billion), marking a 35% rise from the previous year. This growth was primarily driven by foreign investments in data centers and cloud services. Thailand values partnerships that enhance skills and knowledge, supporting initiatives in vocational training, higher education exchanges, and research collaborations. Aligning with the Bio-Circular-Green (BCG) economic model, Thailand seeks partnerships promoting sustainable agriculture, clean energy, and environmental conservation.

What are the positives and bottlenecks of trading with Thailand?

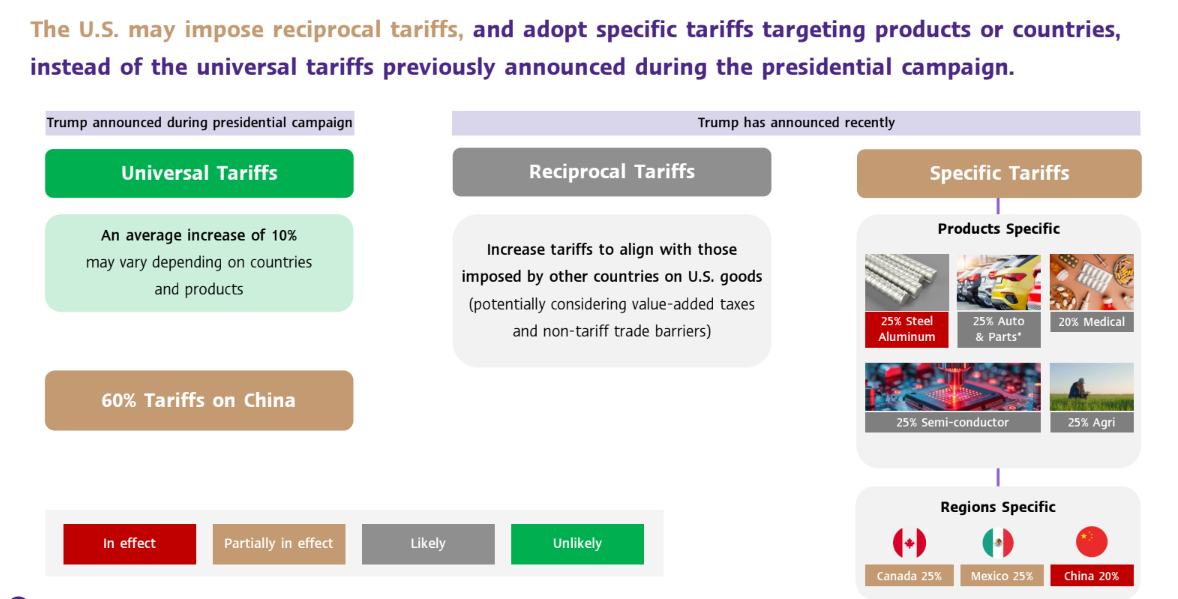

Thailand offers a range of strategic advantages that make it an attractive trade partner. Its geographical location at the heart of Southeast Asia provides convenient access to ASEAN and broader Asia-Pacific markets. This is supported by well-developed infrastructure, including modern ports, airports, and logistics networks, which facilitate efficient movement of goods. Thailand also benefits from an export-oriented economy and a skilled workforce, particularly in sectors such as electronics, automotive, and agro-industrial products. The country’s active participation in regional and global trade agreements significantly enhances its trade competitiveness. Thailand is a member of the ASEAN Free Trade Area (AFTA), the Regional Comprehensive Economic Partnership (RCEP), the ASEAN-Australia-New Zealand Free Trade Area (AANZFTA), and ASEAN+1 FTAs with China, Japan, India, South Korea, and Hong Kong, China. Most recently, Thailand signed its first-ever free trade agreement with the European Free Trade Association (EFTA) in January 2025, marking a notable expansion of its trade network.

Despite these strengths, trading with Thailand can present certain challenges. Customs procedures, while improved in recent years, can still be complex. Businesses may also encounter difficulties navigating Thailand’s regulatory framework. Importantly, Thailand imposes strict penalties for customs violations, including those related to undervaluation or incorrect declarations. In sum, while Thailand presents clear opportunities for trade through its connectivity, agreements, and industrial strengths, businesses must be well-prepared to navigate its regulatory landscape and maintain high standards of compliance to fully leverage the benefits of engaging with the Thai market.

What Thai products should Singapore traders consider to diversify their portfolios while benefiting from attractive pricing and trade conditions?

Yes, Thai products are widely available in Singapore’s retail and commercial sectors. These include staples such as Thai jasmine rice, snacks, sauces, dried and frozen seafood, herbal remedies, and spa products. Thai personal care items—known for their high quality and price competitiveness—are especially abundant and well-received in Singaporean markets. In addition, home goods, decorative items, and popular Thai fashion and lifestyle brands have gained traction, reflecting growing consumer interest in Thai design and craftsmanship. The vibrant Thai community in Singapore, along with the enduring popularity of Thai cuisine, wellness traditions, and tourism culture, have all contributed to the sustained demand and visibility of Thai products across supermarkets, specialty stores, beauty retailers, and online platforms.

Are there any trade agreements or initiatives that can facilitate trade between Singapore and Thailand?

Singapore traders are encouraged to explore a new wave of modern Thai products that reflect innovation, creativity, and sustainability. These include future food solutions such as plant-based protein, functional beverages, and smart packaging, driven by Thailand’s growing agri-tech and food innovation ecosystem. Products aligned with the Bio-Circular-Green (BCG) model, such as natural wellness goods, herbal supplements, and eco-conscious lifestyle items, also present strong appeal amid rising demand for sustainable living.

In addition, Thailand’s creative industries are expanding into digital content, animation, and fashion-tech, offering opportunities in licensing, retail, and collaboration.

If a business wants to find partners or distributors in your country, how should they begin?

Yes, Singapore and Thailand benefit from a comprehensive network of multilateral and bilateral trade agreements that facilitate and enhance trade between the two countries. Both are founding members of ASEAN and participate in the ASEAN Free Trade Area (AFTA), which supports tariff reduction and the free flow of goods, services, and investments within the region. They are also signatories to the Regional Comprehensive Economic Partnership (RCEP)—the world’s largest free trade agreement—as well as the ASEAN-Australia-New Zealand Free Trade Area (AANZFTA), all of which provide improved market access, investment protection, and streamlined customs procedures. In addition, Singapore and Thailand are part of several other ASEAN+1 Free Trade Agreements, including the ASEAN-China Free Trade Area (ACFTA), ASEAN-India Free Trade Area (AIFTA), ASEAN-Japan Comprehensive Economic Partnership (AJCEP), ASEAN-Korea Free Trade Area (AKFTA), and ASEAN-Hong Kong, China Free Trade Agreement (AHKFTA). These FTAs collectively enhance trade opportunities across Asia-Pacific by reducing tariffs and non-tariff barriers and encouraging regional supply chain integration.

Most recently, in March 2025, the two countries signed five Memorandums of Understanding (MOUs) under the Singapore–Thailand Enhanced Economic Relationship (STEER) framework. These cover cooperation in cross-border e-commerce, fintech, consumer protection, and trade in livestock products—reflecting a shared commitment to deepening economic integration and fostering innovation-driven growth. Singapore and Thailand have also implemented Mutual Recognition Arrangements (MRAs) to reduce technical barriers to trade by recognizing each other’s conformity assessment procedures, particularly in the areas of product standards and certifications. Together, these agreements and initiatives create a robust and forward-looking framework that supports bilateral trade, investment, and economic collaboration between Singapore and Thailand.

Can the embassy provide guidance on market research, market entry strategies, or business matching?

For trade-related partnerships, businesses can start by attending major industry events and trade fairs in Thailand—such as THAIFEX–Anuga Asia or STYLE Bangkok—which provide direct access to potential suppliers, distributors, and retail partners. Online platforms like Thaitrade.com also offer verified directories of Thai exporters, while professional networks such as LinkedIn can be useful for identifying and initiating contact with prospective business counterparts.

For investment-related opportunities, companies are encouraged to approach the Thailand Board of Investment (BOI), which offers comprehensive information on priority sectors, investment incentives, and legal procedures. BOI can also facilitate connections with local partners, industrial estates, and relevant government agencies to support market entry and long-term operations.

How can we build lasting alliances between Singapore and your country?

Yes. The Royal Thai Embassy in Singapore can offer preliminary guidance and connect businesses to relevant Thai agencies to support market exploration. We assist by providing insights into consumer trends, advising on entry strategies tailored to different sectors, and facilitating introductions to potential partners.

Over the years, the Embassy has hosted business networking events across diverse sectors—including health and wellness, fast-moving consumer goods (FMCG), and creative industries—serving as a bridge between Thai and Singaporean enterprises. We also coordinate with agencies such as the Thailand Board of Investment (BOI) and the Department of International Trade Promotion (DITP) to help businesses access official resources and identify key opportunities in Thailand.