The central banks of Brunei and Laos have formally joined the Regional Payment Connectivity (RPC), marking a significant step towards enhanced ASEAN economic integration.

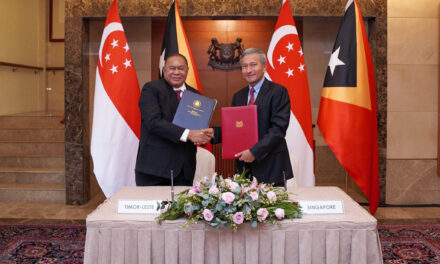

In a landmark move to bolster economic integration within Southeast Asia, the Brunei Darussalam Central Bank (BDCB) and the Bank of the Lao PDR (BOL) have officially joined the Regional Payment Connectivity (RPC) initiative. The formal signing took place with BDCB joining on February 29, 2024, and BOL on April 3, 2024, at the 11th ASEAN Finance Ministers’ and Central Bank Governors’ Meeting in Luang Prabang, Laos.

This expansion brings the total number of ASEAN central banks in the RPC group to eight, including the founding members from Indonesia, Malaysia, Philippines, Singapore, Thailand, and the later addition of Vietnam. The RPC initiative, launched in late 2022, aims to create a more efficient, inclusive, and transparent framework for cross-border payments within the region.

By facilitating faster and more affordable transactions, the RPC is set to enhance the economic capabilities of ASEAN countries. It focuses on modernizing payment systems through QR code-based and fast payment solutions, which are crucial for promoting regional trade, investment, and economic activities. This initiative is especially beneficial for small and medium-sized enterprises (SMEs) by providing them access to international markets and simplifying trade and worker remittance processes.

Hajah Rokiah binti Haji Badar, the Managing Director of BDCB, highlighted the significance of this collaboration for advancing cross-border payment connectivity, which is anticipated to spur further trade, investments, and economic activities within the ASEAN region. She emphasized the importance of close collaboration with fellow central banks to achieve these goals.

Bounleua Xinxayvoravong, the Governor of BOL, echoed the sentiment, underlining the signing of the MOU RPC as a pivotal step towards reinforcing future ASEAN regional cooperation. He pointed out that the initiative would lead to faster, cheaper, and more secure financial transactions, supporting the expansion and sustainability of the ASEAN economies.

The inclusion of Brunei and Laos in the RPC underscores ASEAN’s commitment to enhancing financial inclusivity and economic integration across its member states, promising a more interconnected and prosperous region.

Source – MAS