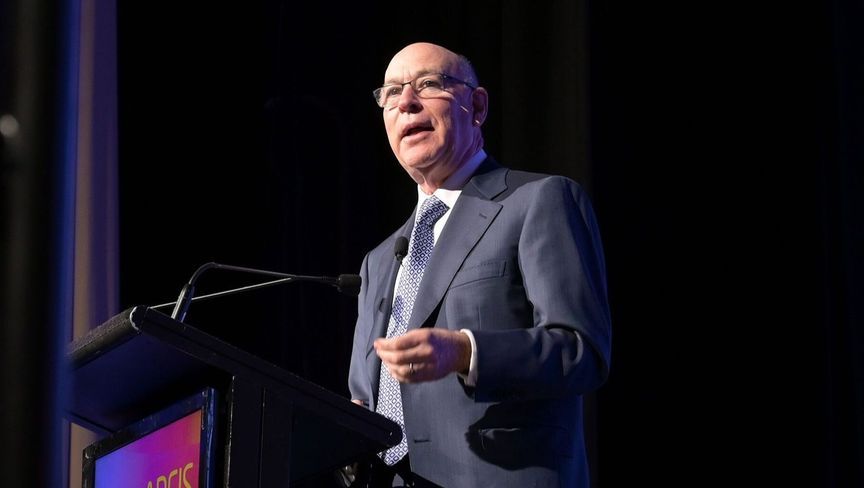

BlackRock CEO Larry Fink announces BlackRock Riyadh Investment Management (BRIM) to boost Saudi investment opportunities.

MIAMI, USA — BlackRock, the world’s largest asset manager, has unveiled plans to establish BlackRock Riyadh Investment Management (BRIM) in partnership with Saudi Arabia’s Public Investment Fund (PIF). This initiative, announced at the Future Investment Initiative (FII) conference in Miami, aims to enhance Saudi Arabia’s capital markets by attracting foreign institutional investments.

Larry Fink, BlackRock’s Chairman and CEO, emphasized the significance of this collaboration, stating, “This is a really exciting milestone in terms of the development of Saudi capital markets.” He further noted that BRIM represents a strategic move to channel global capital into Saudi Arabia, fostering economic growth and diversification.

The partnership will see PIF, which manages approximately $925 billion in assets, providing an initial investment mandate of up to $5 billion to BRIM. This Riyadh-based platform will develop investment strategies across various asset classes, managed by a local team and supported by BlackRock’s global expertise.

This development aligns with Saudi Arabia’s Vision 2030 objectives, aiming to diversify the nation’s economy beyond oil dependence. The National Investment Strategy seeks to increase the private sector’s contribution to GDP to 65% and elevate foreign direct investment to 5.7% of GDP by 2030.

Fink highlighted PIF’s influential role in global finance, noting, “PIF is becoming one of the largest sovereign wealth funds in the world, nearly a trillion dollars today.” He also underscored the mutual benefits of the partnership, stating, “Having a partnership with the fastest-growing sovereign wealth fund in the world is a good example of the connection that we do culturally have together and the opportunities we see as long-term investors.”

The announcement at the FII conference underscores the strengthening economic ties between the United States and Saudi Arabia, with both nations seeking to foster collaborative investment opportunities and bolster economic development.

Source: Public Investment Fund, Saudi Arabia